Your Shopify Client Retention Strategy Reimagined

Jan 9, 2026

|

Published

A smart client retention strategy isn't about chasing new customers—it's about maximizing the Lifetime Value (LTV) and Average Order Value (AOV) of the ones you already have. This means moving away from the old playbook of margin-killing discounts and confusing points systems.

Instead, the focus should be on direct, tangible rewards like native Shopify store credit. This simple shift is what builds real loyalty, boosts profitability, and turns one-time buyers into your most valuable repeat customers.

The Real Cost Of Your Current Retention Strategy

If your brand is stuck on the acquisition hamster wheel, you're not alone. So many DTC businesses believe that growth only comes from a constant flood of new customers. This mindset forces you into a dangerous cycle of offering steep discounts and running promotions just to get people through the door.

Sure, it might give you a temporary revenue bump, but it’s an incredibly expensive and unsustainable way to grow your business.

The truth is, the old playbook of endless coupons and complicated points programs is actively hurting your bottom line. These tactics train your customers to wait for a sale, which erodes your margins and devalues your products over time. You end up attracting bargain hunters who buy once and vanish, not the loyal customers who are the foundation of long-term success and high lifetime value.

The Widening Gap Between Acquisition and Retention

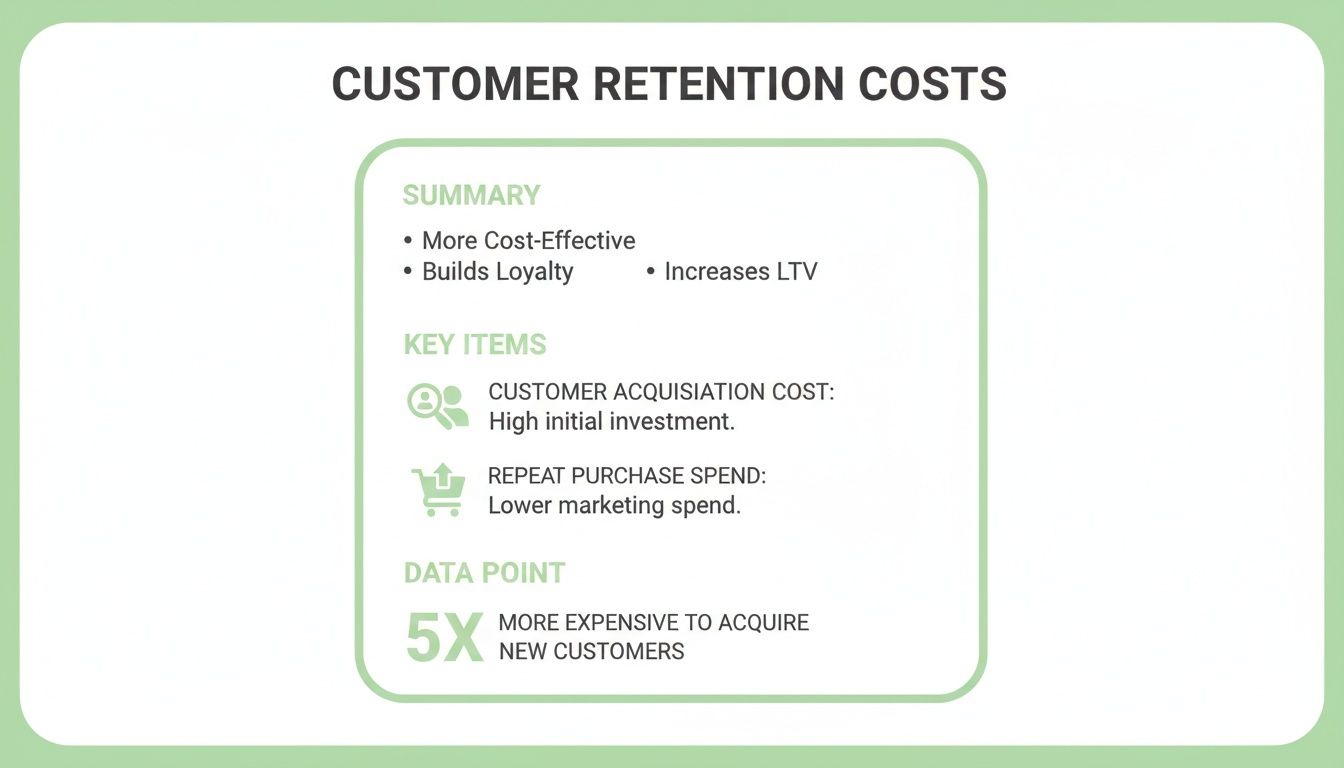

The economics of e-commerce have changed. Relying only on acquiring new customers is a losing game because the costs are just spiraling out of control.

It’s a well-known fact that acquiring a new customer costs about 5 times more than retaining an existing one, and your repeat buyers will spend 67% more than first-timers. For Shopify and DTC brands, this gap has become a chasm. The average e-commerce customer acquisition cost (CAC) skyrocketed from just $9 in 2013 to $29 in 2022—that's a 222% increase.

On the flip side, increasing customer retention by just 5% can boost your profits anywhere from 25% to 95%. The numbers don't lie.

The data makes it crystal clear: investing in the customers you already have delivers a much higher return than constantly chasing new leads.

Moving From Chasing Revenue To Building Profit

The most successful DTC brands see this shift and are changing their focus. Instead of obsessing over top-line revenue, they're building durable retention strategies centered on profitability. This means prioritizing metrics like Customer Lifetime Value (LTV) and Average Order Value (AOV).

Think about it: a customer who buys once at a 40% discount has a pretty low LTV. But a customer who comes back multiple times to purchase at full price? They are exponentially more valuable to your business.

The core of a profitable retention strategy is creating a system that rewards loyalty without sacrificing your margins. It's about making your existing customers feel valued so they choose to spend more, more often, directly increasing their LTV.

Understanding the real cost of your current strategy is the first step. Diving into practical tips to engage and retain users can really highlight the value of a better approach.

The Power of Shopify Store Credit

This is where a smarter alternative comes into play: native Shopify store credit. It’s a complete game-changer because it functions like cash, not a gimmick.

A discount code slashes the value of an entire cart, but store credit is a specific dollar amount that genuinely encourages customers to come back and spend. It feels like a real reward, not just another transactional coupon. It's the key to increasing AOV and LTV without the margin damage of discounts.

Let's look at how these common tactics stack up against each other.

Store Credit vs Discounts vs Points Systems

Metric | Shopify Store Credit | Discount Codes | Points Programs |

|---|---|---|---|

Margin Impact | High protection. Controlled, fixed-dollar value prevents deep cuts into total order value. | Low protection. Percentage-based discounts can significantly erode margins, especially on large orders. | Moderate protection. Can be complex to model and may devalue products over time. |

Customer Experience | Simple and intuitive. Feels like cash waiting to be spent, creating a positive, tangible reward. | Transactional. Can feel cheap and trains customers to wait for sales, devaluing the brand. | Often complex. Customers must track points and understand conversion rates, which adds friction. |

LTV Potential | Very high. Directly incentivizes the next purchase and encourages spending beyond the credit amount. | Low. Attracts one-off bargain hunters who are unlikely to become loyal, full-price customers. | Moderate. Can build long-term habits, but the reward often feels distant and less immediate. |

AOV Impact | Positive. Customers often spend more than their credit balance to "get the most" out of their reward. | Neutral to Negative. Often used to simply lower the price of a planned purchase without adding to the cart. | Neutral. The focus is on earning points for future use, not necessarily on increasing the current cart size. |

The comparison makes it pretty obvious. Store credit isn't just another loyalty tactic; it's a fundamentally better financial and psychological tool for building a profitable relationship with your customers.

By making this one simple switch, you can achieve several key goals at once:

Protect Your Margins: You aren't just giving away a percentage of the total sale anymore.

Increase Average Order Value: Customers often spend more than their credit amount to make the reward feel worthwhile.

Drive Repeat Purchases: The credit is a powerful, tangible reason for them to come back for a second, third, or fourth purchase, boosting LTV.

This single change can transform your client retention strategy from a cost center into a powerful profit engine. It sets the stage for sustainable growth that's built on a foundation of genuine customer loyalty, not just fleeting discounts.

Building Your High-Impact Store Credit Program

This is where the rubber meets the road—building your new retention engine. Let’s move past the generic templates and confusing point systems that customers just ignore. The best retention strategies I’ve seen are always the simplest: they're profitable for the business and feel genuinely rewarding for the customer.

The goal here is to get away from the race-to-the-bottom feeling of constant discounts. We're creating a system that actually drives up your Average Order Value (AOV) and, more importantly, your Customer Lifetime Value (LTV).

At its heart, a store credit program is just rewarding spending with a real asset—cash back for their next purchase. This simple idea is incredibly powerful. Unlike a discount code that just cheapens your product in the customer's eyes, store credit feels like earned money. It creates a powerful psychological itch for them to come back and spend it.

How you structure the program is everything. It has to be generous enough to get people to act but smart enough to protect your margins and actually make you more money.

Designing Your Reward Structure

You really have two solid paths here: a simple cashback offer or a tiered system. Which one you choose depends entirely on your brand's AOV and how your customers typically shop.

The Flat Cashback Model: This is the easiest to pull off and for customers to understand. Think "Spend $100, Get $10 Back." It's clean, direct, and fantastic for nudging customers to hit a specific spending target to unlock their reward. It's my go-to for increasing AOV.

The Tiered Rewards Model: This approach gets a little more sophisticated, offering bigger rewards as customers spend more. For example: spend $75, get $5; spend $150, get $15; spend $300, get $40. Tiers work wonders for brands with a wide range of product prices because they incentivize both the smaller carts and the big spenders.

The trick I always recommend is to set your first reward threshold just above your current AOV. If your average order is around $85, setting that first tier at $100 is a natural way to get people to toss one more item in their cart. This is how your retention strategy starts directly fueling AOV growth.

To see how you can set this up natively, we've put together a full guide on using Shopify store credit.

Defining Your Key Performance Indicators

You can't know if this is actually working unless you're tracking the right numbers. It's time to stop obsessing over vanity metrics like traffic and look at the KPIs that really matter for profitability.

These are the only metrics you need on your retention dashboard:

Repeat Purchase Rate (RPR): The percentage of customers who come back to buy again. This is the single most important measure of your retention efforts.

Customer Lifetime Value (LTV): The total profit you can expect from a single customer over time. Every retention program should have one clear mission: make this number go up.

Average Order Value (AOV): The average amount spent per order. Your reward tiers should be engineered to constantly lift this metric.

Reward Redemption Rate: The percentage of issued store credit that actually gets used. A high redemption rate is a fantastic sign—it means your program is engaging and bringing people back.

A simple dashboard showing these numbers gives you an immediate, at-a-glance view of your program's health and its direct financial impact. You can see exactly how much credit has been earned, how much was redeemed, and how many repeat sales it drove.

Setting Achievable and Profitable Goals

This is what separates a cost center from a profit center. Forget vague goals like "increase loyalty." You need to set specific, measurable targets tied directly to those KPIs we just talked about.

Your goal isn't just to give away rewards. It's to profitably change customer behavior. Store credit should be an investment in a future purchase, not just another cost eating into your margins on the current one.

The data backs this up, time and time again. A recent survey of U.S. sales leaders revealed that 59% named loyalty programs as their most effective tool for long-term customer retention. And it gets better: loyalty members generate 12–18% more incremental revenue per year than non-members. That lift is even more powerful when the reward is store credit, which guarantees that value comes right back to you.

Here’s what strong, data-driven goals actually look like:

Increase our 60-day Repeat Purchase Rate from 15% to 22% within Q1.

Lift our Average Order Value by $15 by setting our main reward tier just above our current AOV.

Boost our average Customer Lifetime Value by 25% over the next 12 months.

When you design a thoughtful reward structure and relentlessly track the metrics that matter, your store credit program stops being just another marketing tactic. It becomes a predictable, measurable, and highly profitable engine for sustainable growth.

Driving Adoption With Smart Communication

You've built a brilliant store credit program—a powerful engine for your retention strategy. But here's the reality: it can't drive repeat purchases if your customers don't even know it exists. The success of your launch and its long-term impact comes down to clear, compelling, and consistent communication.

Your mission is to weave the value of store credit into the entire shopping experience, making it an unmissable reason for customers to come back. You can't just set it and forget it. Getting this right is an ongoing effort that starts with a big splash and continues through every single customer touchpoint, using every tool you have—email, SMS, and on-site elements—to keep that earned credit top-of-mind.

Announcing Your New Rewards Program

Your launch absolutely sets the tone for the entire program. The goal is to generate genuine excitement and spell out the value in plain English. You want to frame this as a major upgrade, especially if you're moving away from a confusing old points system.

Here's a simple playbook for a high-impact launch announcement:

Emphasize Simplicity: Lead with the core benefit. Something like, "Get real cash back on every order" or "Your loyalty now pays you back" lands much harder than explaining a bunch of complicated rules.

Highlight the "Why": Give a quick explanation that you're ditching confusing points and one-off discounts for a simpler, more valuable system. It’s a way of saying thank you to your best customers, and that message resonates.

Show, Don't Just Tell: A simple graphic illustrating the concept (e.g., Spend $100, Get $10) makes it instantly understandable. Visuals cut through the noise.

This initial announcement needs to be a multi-channel blast. Hit your email list, post it on social media—get it everywhere to ensure you have momentum from day one.

Integrating Credit Into Post-Purchase Flows

The moment a customer earns credit is your single best opportunity to reinforce its value and plant the seed for their next purchase. This is where your automated post-purchase communication becomes a critical part of your entire retention strategy.

Don't just send a generic order confirmation. Create a dedicated email or SMS flow that actually celebrates their new balance.

Pro Tip: Don't just state the credit amount. Frame it as a head start. For example, instead of a flat "You earned $10," try "You've got $10 toward your next order!" This subtle shift in language turns a notification into a compelling call to action.

You can easily integrate these notifications into your existing marketing tools like Klaviyo or Attentive. A simple, automated flow that triggers an email the moment store credit is issued creates a delightful surprise that immediately strengthens that customer's connection to your brand.

Keeping The Value Visible On-Site

Out of sight, out of mind. I've seen countless programs fail because of this simple fact. The most effective programs make sure customers are constantly reminded of the "cash" they have waiting for them.

This is where on-site elements are a game-changer for driving redemptions and boosting your Average Order Value.

A floating wallet widget is the perfect tool for this. It's a small, non-intrusive element that sits in the corner of your site, displaying the customer's current store credit balance as they browse. Every time they see it, they're reminded of the value they have waiting, making them far more likely to add items to their cart and check out.

This constant visibility does two key things for you:

It drives repeat visits: A customer who knows they have $15 in credit is much more likely to come back to your site to browse.

It increases AOV: Seeing that credit balance often motivates shoppers to spend more than the credit amount just to "make the most of it."

Using Timely Reminders to Create Urgency

While store credit shouldn't feel like a fleeting discount, a little bit of urgency can be a powerful motivator. Sending timely reminders prevents that hard-earned credit from being forgotten and gently nudges customers back to your store.

Consider setting up automated reminders for customers who haven't used their credit after 30 or 60 days. These messages can be simple and friendly, with a subject line like, "Just a heads-up! Your $10 store credit is waiting for you!"

This isn't about high-pressure sales tactics. It's about providing a helpful reminder that reinforces the value you've already given them. When you combine a big launch, celebratory post-purchase flows, constant on-site visibility, and gentle reminders, you transform your store credit program from a passive feature into an active, engaging engine for real customer loyalty and profitable growth.

Using Personalization To Maximize Loyalty

One-size-fits-all rewards just don't cut it anymore. When every customer gets the same generic offer, nobody feels special. Real loyalty—the kind that builds serious lifetime value—is earned when customers feel like your brand actually gets them.

This is where you graduate from a simple store credit program to a sophisticated client retention strategy. It's time to stop shouting the same offer at everyone and start using smart segmentation and personalization to make each customer feel like a true insider.

Identify Your Key Customer Segments

First things first: stop thinking of your customer base as a single, faceless mob. The real magic happens when you break it down into smaller, actionable groups based on how they actually shop. This lets you deploy your store credit offers with surgical precision where they'll make the biggest splash.

From my experience, these are the three segments you absolutely need to start with:

Your VIPs (High-LTV Customers): These are the champions of your brand. They’re your repeat buyers, your biggest spenders, and the rock-solid foundation of your profitability. For them, the goal isn't just retention; it's about delighting them so much they can't imagine shopping anywhere else.

Your At-Risk Customers: Think of the regulars who’ve gone quiet. Maybe they haven't bought anything in 60 or 90 days. A well-timed, personal nudge is often all it takes to bring them back into the fold before they churn for good.

Your One-Time Buyers: This group is pure, untapped potential. They liked you enough to buy once, but something stopped them from coming back. Your job is to give them an irresistible reason to make that second purchase and start their journey toward becoming a loyal fan.

Once you know who you're talking to, you can stop throwing rewards into the void and start investing them where they'll actually drive a return. For a deeper dive, check out our guide on how to use market segmentation to refine your marketing efforts.

Crafting Targeted Store Credit Offers

With your segments clearly defined, you can now build specific store credit campaigns designed to spark the right action from each group. This is where personalization really comes alive.

Imagine sending a surprise "$25 Thank You" credit to a high-LTV customer on the anniversary of their first purchase. It’s an unexpected gesture that reinforces how much you value their business, making them feel genuinely appreciated and locking in their loyalty.

For an at-risk customer, a compelling "$15 We Miss You" credit can be a game-changer. It’s a low-risk, high-reward play to reactivate their interest and remind them why they loved your brand in the first place.

The modern client retention strategy is all about experience and personalization. In fact, 71% of consumers now expect personalized interactions, and a whopping 60% say it directly motivates them to buy again. When you nail this, you make customers feel like you're paying attention to them as individuals, not just as order numbers.

Real-World Scenarios For Personalized Rewards

Let's make this crystal clear. Here are a couple of real-world plays you can run to use targeted store credit to boost both your Average Order Value (AOV) and Lifetime Value (LTV).

Scenario 1: The VIP Anniversary Gift You have a top customer who has spent over $1,000 with you. Their two-year anniversary with your brand is coming up.

The Play: Automate an email with the subject line, "A special gift to celebrate you!" Inside, you grant them $30 in store credit with zero strings attached.

The Impact: This surprise-and-delight moment doesn't just feel good; it strengthens an already fantastic relationship, all but guaranteeing their next purchase and adding to their long-term LTV.

Scenario 2: Winning Back a Lapsed Customer A customer who used to buy every month hasn't placed an order in 95 days.

The Play: Trigger an automated SMS that says, "Hey [First Name], we've missed you! Here's $10 in store credit to use on your next order."

The Impact: This personal, direct outreach is often the perfect catalyst to reignite their interest. The credit gives them a tangible, low-friction reason to come back and browse.

By tailoring your approach, you transform store credit from a simple discount into a powerful tool for building real brand affinity. You’re not just running a promotion; you’re creating a personalized experience that makes each customer feel seen. That, right there, is the secret to a client retention strategy that drives sustainable, profitable growth.

Measuring What Actually Matters

So, how do you know if this new retention strategy is actually working? You can't just go by a gut feeling. The proof is in the data, but you have to be looking at the right numbers—the ones that signal real profitability and long-term health.

Moving away from the discount hamster wheel to a store credit model is meant to change how your customers shop for the better. This shift has a direct impact on a few core metrics that truly move the needle. Let's ditch the vanity metrics and focus on the numbers that hit your bottom line.

Your Essential Retention Dashboard

To see the health of your program at a glance, you really only need to track four key metrics. These KPIs tell the whole story, from a customer's first repeat purchase to their long-term value.

Here's your must-watch list:

Repeat Purchase Rate (RPR): This is the big one. It's the percentage of customers who come back to buy again. A rising RPR is the clearest sign that your store credit strategy is doing its job and bringing people back.

Average Order Value (AOV): How much do people spend when they check out? Because store credit feels like free money, shoppers are often nudged to add more to their cart to "use up" their reward. You should see a nice, steady lift here.

Customer Lifetime Value (LTV): This is the ultimate metric. It’s the total profit you can reasonably expect from a single customer over their entire time with you. Every single part of your retention playbook should be designed to drive this number up. If you want a full walkthrough, check out our guide on how to calculate customer LTV for your store.

Reward Redemption Rate: What percentage of the store credit you issue actually gets used? A high redemption rate is a fantastic signal. It proves customers find the reward valuable enough to make another purchase.

These four metrics give you a clear, unfiltered view of your program's impact. They show you exactly how your investment in loyalty is turning into profitable customer behavior.

Connecting Your Efforts to Real-World Results

It's one thing to track these numbers, but it’s another to see how they fit into the bigger picture. A solid store credit program doesn't just improve retention; it has a positive ripple effect across your entire marketing ecosystem.

When your retention engine is firing on all cylinders, you'll see the benefits everywhere. A higher LTV, for instance, means you can afford a higher customer acquisition cost (CAC). That gives you a massive competitive advantage in paid ad channels.

If you want to dig deeper into how all the pieces fit together, resources on measuring digital marketing effectiveness offer a great framework. The core idea is simple: by building a more valuable customer base, you make every other part of your marketing more efficient and profitable.

A/B Testing Your Way to Higher Profits

Your first reward structure is a great starting point, but it shouldn't be your last. The most successful brands I've worked with are constantly tweaking and refining their approach to find out what really clicks with their customers. This is where A/B testing becomes your secret weapon.

Don't be afraid to run some experiments with different reward structures and messages. It's the only way to see what really moves the needle.

Here are a few simple tests you can run right away:

Reward Thresholds: Pit a "Spend $75, Get $5" offer against a "Spend $100, Get $10" offer. Does the higher threshold successfully push your AOV up without tanking your conversion rate?

Messaging: Try out different email subject lines for your credit reminders. Does "Your $10 reward is waiting!" outperform "A little gift from us to you"?

Timing: Play with the timing of your reminder emails. Does a 30-day reminder work better than a 45-day one to bring lapsed customers back into the fold?

By methodically testing these small variables, you can fine-tune your retention strategy over time. Each successful test delivers small wins that add up to a much bigger return, ensuring your program becomes an increasingly powerful growth engine for your brand.

Got Questions About Using Store Credit? Let's Dig In.

I get it. Shifting your entire retention strategy feels like a big move, and it's bound to bring up some questions. Moving to a Shopify store credit model is one of the smartest plays you can make for long-term profitability, but you need to be confident in the "why" before you jump in.

So, let's tackle the questions I hear most often from Shopify brand owners who are ready to finally ditch the discount-heavy, low-margin loyalty game. Getting these answers straight will give you the clarity you need to build a program that actually grows your LTV.

Is Store Credit Really Better Than a Points System?

Yes, and it’s not even close. The magic of store credit is in its dead-simple clarity.

Your customers get it instantly. $10 in credit means $10 to spend. There are no weird conversion rates, no mental math trying to figure out what 500 points really means. It feels like cash in their pocket, and that’s a powerful motivator.

This simplicity is why store credit programs see much higher engagement and redemption rates than points-based systems. Plus, when it’s native to Shopify, the checkout experience is buttery smooth. You’re not wrestling with clunky, site-slowing third-party apps that fracture the customer journey.

The real win here is psychological. Store credit feels like a gift, a tangible balance they already own. This creates an immediate itch to come back and spend it, something points rarely achieve.

Won't This Just Wreck My Profit Margins?

This is probably the biggest fear I hear, but it’s based on a misunderstanding of the mechanics. The truth is, a well-run store credit strategy is designed to protect your margins, not destroy them.

Think about it. A blanket 20% off coupon code indiscriminately slashes your margin on an entire order. You're giving away profit on a sale you might have gotten anyway. Store credit is surgical.

You issue a fixed-dollar amount—say, $10—which nudges customers to spend more to use it, often on full-priced items. To redeem that $10 credit, they might build a cart worth $75 or more. You've just protected the margin on the other $65 while boosting your Average Order Value (AOV).

Most importantly, store credit only becomes a "cost" when a customer makes another purchase. You aren't just giving money away; you're making a smart investment in a guaranteed repeat sale from a customer who is actively increasing their lifetime value.

How Painful Is It To Migrate From an Old Loyalty App?

Way less painful than you're imagining. The key to a smooth transition is all in the framing. You’re not taking something away; you're giving your customers a massive upgrade to a simpler, more valuable program.

Communication is everything. You need to get out ahead of it and announce the change with genuine excitement. Let them know their hard-earned loyalty is being converted into real, spendable cash in their account.

The technical lift is pretty straightforward, too:

First, you’ll export all your customer data (like point balances) from your current loyalty app.

Next, you'll decide on a fair conversion rate that turns their points into a generous store credit value.

Finally, with the right tools, you can bulk-import these new balances right into Shopify’s native system.

This whole process ensures your most loyal customers feel seen and rewarded from day one. When you handle the migration with care, you actually strengthen their loyalty instead of creating friction. It’s the final step in launching a client retention strategy that’s actually built for profitable, sustainable growth.

Ready to transform your retention strategy and boost LTV without sacrificing your margins? Redeemly makes it simple to launch a native Shopify store credit program that your customers will love. Discover how Redeemly can drive profitable growth for your brand.

Join 7000+ brands using our apps