Decrease Customer Churn: Boost LTV with Native Shopify Store Credit

Jan 28, 2026

|

Published

If you want to get serious about reducing customer churn, it’s time to rethink the entire discount and loyalty game. For too long, Shopify brands have been stuck using temporary discount codes and confusing points systems. The key to sustainable growth is a native store credit program—a strategy that creates a real, tangible reason for customers to come back, directly boosting lifetime value (LTV) and average order value (AOV).

Why Your Discount Strategy Is Actually Driving Customers Away

Let's be honest. It feels like you have to run "15% OFF" promotions just to stay competitive. You launch a sale, the orders flood in, and it feels like a win. But what’s really happening under the surface? You're accidentally training your customers to never pay full price.

This creates a transactional relationship, not a loyal one. You end up attracting deal-hunters who have zero connection to your brand. The moment the sale is over, so are they—off to find the next best offer, whether it's from you or a competitor. This endless cycle of discounting absolutely kills your profit margins and, ironically, does nothing to stop customers from churning. It’s a direct hit to your potential lifetime value.

The Problem With Points And Complicated Systems

Okay, so maybe you've realized the deep flaws in constant discounting and switched to a points-based loyalty program. It sounds great on paper, right? Reward customers for spending, and let them cash in points later.

But in reality, these systems often create more confusion than loyalty. Your customers are left scratching their heads, wondering:

How many points do I even have?

What is a point actually worth?

Where do I redeem these at checkout?

This confusion is a massive barrier. Instead of feeling appreciated, your customers feel like they need a PhD in math just to figure out the value. The reward feels abstract and far away, which fails to create that immediate urge to make another purchase. For a more comprehensive look at keeping customers engaged, it’s worth digging into how to improve customer retention with a solid game plan.

Shifting Focus To Lifetime Value With Store Credit

To truly break this cycle, you have to shift your entire focus from one-off sales to long-term customer relationships. This is where a native Shopify store credit program completely changes the dynamic. Instead of a forgettable discount code or a pile of confusing points, you give customers real, cash-like value that lives right in their account.

A dollar in store credit just feels different than a 10% off coupon. It’s perceived as earned money that’s waiting to be spent, creating a powerful psychological pull to come back to your store.

This simple pivot transforms customer behavior. Shoppers are now motivated to increase their cart size to unlock bigger credit rewards, boosting AOV. That earned credit then becomes a powerful reason to return for a second, third, and fourth purchase, maximizing LTV. In a world where e-commerce churn rates can hit 22% annually, this shift isn't just nice—it's necessary for survival.

To put it in perspective, let’s compare these approaches side-by-side.

Discount Coupons vs. Store Credit Rewards

Metric | Discount Coupons & Points | Native Store Credit (e.g., Redeemly) |

|---|---|---|

Profit Margin | Erodes margins with every use; trains customers to expect lower prices. | Protects margins by rewarding after a full-price purchase. |

Customer LTV | Attracts one-time deal seekers, leading to lower LTV. | Encourages repeat purchases, directly increasing LTV. |

AOV | Often used on the smallest possible order to get a deal. | Motivates customers to spend more to earn higher credit tiers. |

Brand Loyalty | Creates transactional relationships based on price, not value. | Builds genuine loyalty and a sense of "money in the bank." |

Customer Experience | Can be confusing (point values, expiration dates, coupon codes). | Simple and transparent—customers see a clear dollar value. |

The data is clear. While discounts offer a short-term bump, store credit builds a sustainable foundation for growth.

Brands that adopt automated retention tools and value-based incentives consistently see lower churn. By making native store credit the core of your strategy, you stop just making sales and start investing in a customer's lifetime value. For even more ideas on this, check out our guide on powerful retention marketing strategies.

How to Diagnose Your Store's Churn Problem

Before you can fix a leaky bucket, you have to find the holes. To actually make a dent in your churn rate, you have to stop guessing why people leave and start digging into the data to find the exact drop-off points in your customer journey. The good news? You don’t need a complex data science degree to do this.

For anyone on Shopify, the most critical insights are already waiting for you. By zeroing in on a few key metrics, you can get a surprisingly clear picture of your store’s health and spot at-risk customers before they disappear for good. Forget about getting lost in overwhelming spreadsheets; let's focus on the numbers that actually matter.

Start with the Basics: Your Churn Rate

First things first, you need a baseline. Your customer churn rate is simply the percentage of customers who stopped buying from you over a specific period. Think of it as the vital sign that tells you if your retention efforts are working or falling flat.

Calculating it is pretty straightforward:

(Lost Customers ÷ Total Customers at the Start of the Period) x 100 = Churn Rate %

So, if you started the month with 1,000 customers and 50 of them didn't come back, your monthly churn rate is 5%. While this number is a crucial starting point, the real magic happens when you dig one level deeper to understand who is churning and when.

Identify Your Critical Drop-Off Points

I've worked with countless DTC brands, and I can tell you that the biggest customer drop-off almost always happens right after the first purchase. A customer buys once, has an okay (but forgettable) experience, and then... crickets. This is a massive missed opportunity to build real lifetime value.

Your goal is to pinpoint exactly where this is happening. Jump into your Shopify analytics and start asking the right questions:

What's the average time between the first and second purchase? If this window is ridiculously long—or non-existent for most people—you've got a classic "one-and-done" customer problem.

Which products have the worst repeat purchase rate? You might find that certain products attract one-time buyers, which tells you that you need a much better post-purchase follow-up for those specific items.

What percentage of customers use a big discount on their first order and never buy again? This is a big one. It reveals if your promotions are attracting loyal fans or just temporary deal-seekers.

The period between the first and second sale is the most fragile part of the entire customer relationship. Nailing this transition is how you turn a one-time buyer into a lifelong advocate.

By identifying these friction points, you move from a vague "our churn is high" problem to a specific, solvable one, like, "We're losing 70% of first-time buyers who purchased Product X with a coupon." Now that's a clear target for your retention strategy. Understanding these figures is fundamental, and you can learn more about how to track the right numbers in our deep dive on key user retention metrics.

Segment At-Risk Customers with AOV and LTV

Let's be honest: not all customers are created equal, and not all churn is equally damaging. Losing a high-value customer who buys from you every month hurts way more than losing someone who bought a single low-ticket item a year ago. This is where segmenting by Average Order Value (AOV) and Lifetime Value (LTV) becomes a game-changer.

Go into your Shopify customer list and create a few simple segments based on their spending habits:

High-Value, High-Frequency Shoppers: These are your VIPs, your ride-or-dies. Even a slight dip in their engagement is a major red flag that requires immediate, personalized attention.

High-Value, Low-Frequency Shoppers: These customers spend big, but you only see them once in a blue moon. The goal here is to shorten that time between purchases, maybe with a well-timed store credit offer.

Low-Value, High-Frequency Shoppers: These folks are loyal but cautious with their cash. Your objective should be to gently nudge their AOV up by incentivizing them to add just one more thing to their cart.

Low-Value, Low-Frequency Shoppers: This is almost always your most at-risk segment. They haven't found a compelling reason to stick around and are the most likely to churn without a second thought.

Once you have these segments, you can analyze their behavior. You’ll probably find that your "Low-Value" segments are the ones churning most often. This isn't just a churn problem—it's a value problem. These customers haven't been convinced that your brand is worth investing more in. That diagnosis is the crucial first step toward building a targeted strategy to boost their engagement and spending.

Building Your Margin-Friendly Store Credit Program

Once you’ve pinpointed the leaky spots in your customer journey, it’s time to build the plug. A native Shopify store credit program isn’t just another loyalty gimmick; it’s a strategic shift designed to build long-term value. You're moving away from margin-killing discounts and abstract points to a tangible, cash-like incentive that protects your profitability while actively working to decrease customer churn.

The goal here is simple: create a program so valuable and easy to use that it becomes a no-brainer for your customers. Forget confusing tiers and hoops to jump through. We're talking about a straightforward system that starts boosting both your average order value (AOV) and lifetime value (LTV) from day one.

The Power of Cash-Like Incentives

Think about the psychology for a second. A "15% off" coupon feels fleeting, almost transactional. A bunch of points feels like homework—something you have to calculate and figure out. But $10 in store credit? That feels like real money just sitting in their account, begging to be spent.

That's the entire game. You’re not just offering a discount; you’re giving the customer a real asset. This asset is what pulls them back to your store, turning a potential one-and-done buyer into a loyal repeat customer. It’s an investment in their next purchase, not a tax on their last one.

The best retention strategies make customers feel like they have a real stake in your brand. Store credit nails this by creating a tangible balance—'money in the bank'—that belongs to them. It makes the decision to come back and shop again almost effortless.

When you frame rewards this way, you shift the customer’s mindset from, "How can I save a few bucks?" to, "How can I make the most of the money I already have with this brand?" This small but critical shift is where sustainable loyalty is born.

Structuring Your Automated Rewards

The real beauty of a native Shopify store credit system is its simplicity. You can set up automated, set-it-and-forget-it rules that reward customers without you lifting a finger. The most effective structure I've seen is almost always the simplest: a classic spend-and-get model.

For example, you could roll out a rule like: “Get $10 in store credit for every $100 spent.”

This one simple rule hits several critical goals at once:

It boosts AOV: A customer staring at an $85 cart is suddenly very motivated to find one more thing to hit that $100 mark and snag their reward.

It’s dead simple to understand: No math, no guesswork. Customers see a clear reward and a clear path to get it.

It protects your margins: The reward is only issued after a full-price purchase, and it only becomes a cost when they redeem it on a future purchase.

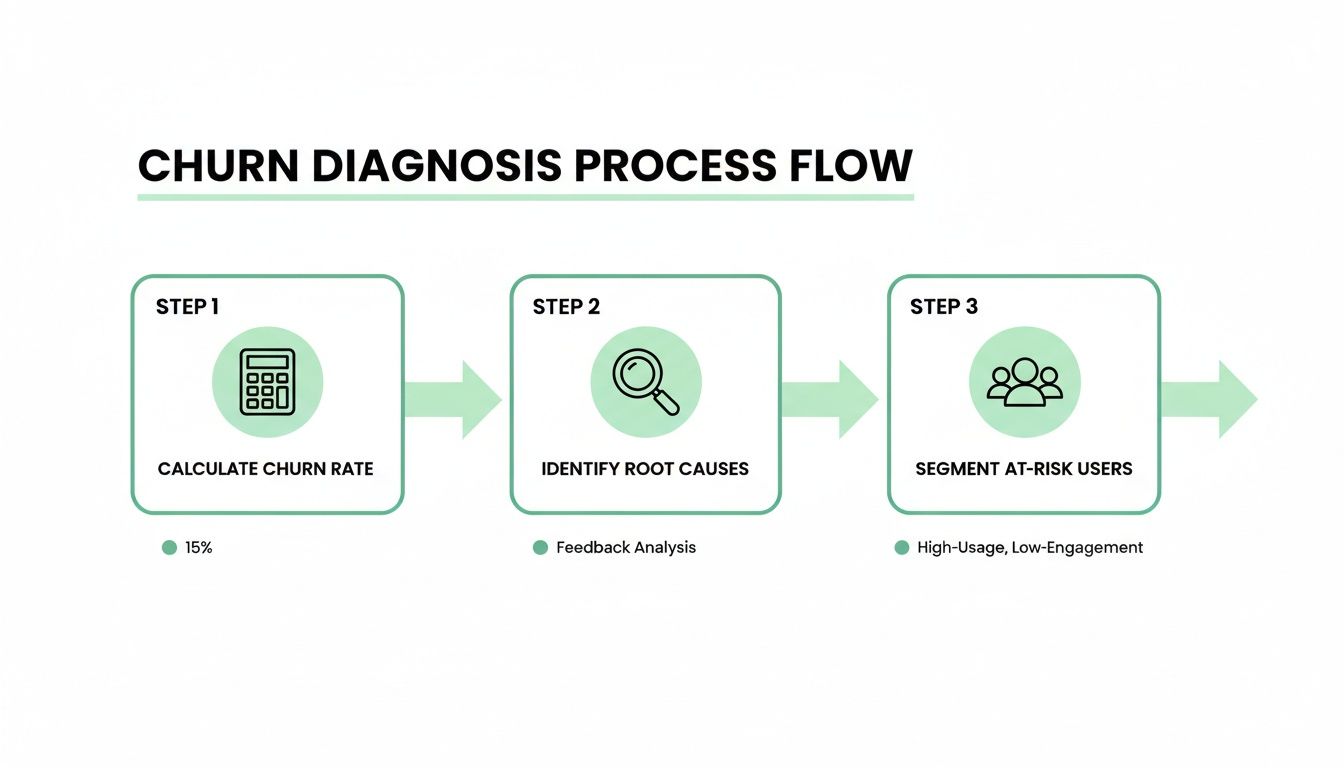

This entire process—diagnosing churn risks and then implementing a targeted retention tool like store credit—is the foundation. The flowchart below visualizes these first crucial steps of taking your store's pulse before you launch any program.

This "calculate, identify, and segment" workflow is the strategic homework that makes a store credit program so powerful. It ensures you aren't just spraying rewards at everyone but are building a system that targets the specific behaviors you’ve already flagged as churn risks.

Why a Native Shopify App Matters

When you're deciding how to put this all in place, going native is a game-changer. So many third-party loyalty platforms rely on heavy, external scripts that can absolutely wreck your site speed—a known conversion killer. A native app like Redeemly, built directly on Shopify’s own store credit system, dodges that bullet completely.

You avoid clunky widgets and confusing external portals. The store credit just lives inside the customer's native Shopify account, making the entire experience seamless. This tight integration means setup is quick, performance is lightning-fast, and the customer journey never feels disjointed. To see just how straightforward it is, we've put together a full guide on how to issue store credit on Shopify.

This entire approach is heavily inspired by proven retention tactics from the SaaS world. A seemingly small monthly churn of just 5% can snowball into a staggering 46% annual customer loss, but a powerful retention engine can completely reverse that tide. For Shopify brands, a native solution is that engine. It issues credit directly on Shopify's system—no scripts, no hassle—and uses on-site wallets and checkout reminders to get customers back.

The data backs this up. Industries that switch to value-aligned incentives see retention climb as high as 84%, blowing past the 55% average in sectors like hospitality. By building a margin-friendly program with a native solution, you’re not just tacking on a feature. You’re installing a powerful, automated system designed to boost every key metric—from AOV to LTV—and turn your customer base into a predictable, profitable engine for growth.

Let’s Talk About Automating Your Communication to Boost Redemptions

So, you’ve put together a brilliant, margin-friendly store credit program. It's designed to pump up your AOV and keep customers coming back. But here's a dose of reality I’ve seen time and again: out of sight is truly out of mind.

Even the most generous store credit is completely useless if your customers forget they have it. This is where getting your automated communication dialed in becomes your secret weapon to decrease customer churn.

The trick isn’t to blast your customers with a firehose of marketing messages. It's about weaving timely, helpful reminders into their experience that keep their earned credit front and center. When done right, you can consistently nudge them back to your store without ever feeling pushy.

Make That Store Credit Impossible to Ignore

Your customers shouldn't have to go on a scavenger hunt to find their balance. Honestly, the most effective strategy is to bake their credit balance right into the on-site shopping experience. This move transforms their credit from some abstract number into a tangible, ever-present reason to shop.

One of the slickest ways to pull this off is with an on-site floating wallet widget. It’s a small, subtle element that sits in the corner of the screen, showing a customer's available credit as they browse. It becomes this constant, positive whisper of "you've got money to spend."

Think about it: when a customer sees their $15 store credit on every single page, it fundamentally changes how they shop. That credit is no longer a forgotten perk; it's an immediate tool that makes adding one more item to their cart feel like a no-brainer.

This constant visibility is a total game-changer. It turns a passive reward into an active driver for both conversions and AOV, which directly fuels repeat purchases and a much healthier LTV.

Crafting Your Automated Email and SMS Flows

While the on-site reminders are your closer, your off-site communication is what gets customers back through the virtual door. You really only need a few key email and SMS flows to reach people at the moments that matter most.

The philosophy here is to be helpful and timely, not spammy.

Here are the automations I consider non-negotiable for any store credit program:

The "Credit Earned" Ping: This should fire off the second a customer makes a qualifying purchase. It needs to clearly state how much credit they earned and what their new total is. This little dopamine hit reinforces the value of their purchase.

The "Balance Reminder" Nudge: This is for customers who have gone quiet. A simple email or text 30-45 days after their last purchase saying, "Hey, you've still got $10 waiting for you!" is incredibly effective at reactivating someone who has lapsed.

The "Expiration Warning" (If You Use Them): If your credits expire, a heads-up is a must. A short series of reminders—maybe 14 days out and then again 3 days before—creates a bit of urgency without being obnoxious. It’s a powerful play to drive action and prevent breakage.

A Quick Look at These Automations in Action

Let's make this real. Say a customer named Sarah just spent $120 at your store and earned $12 in credit. Her automated journey might look like this:

Immediately After Purchase (Email):

Subject: You've Earned $12 in Store Credit!

Body: "Thanks for your order, Sarah! As a thank you, we've added $12 to your store credit balance. It's ready for you to use on your next purchase."

30 Days Later (SMS):

Message: "Hi Sarah! Just a friendly reminder that you have $12 in store credit waiting for you at [Your Store]. Come find something you'll love!"

See how that works? These simple, automated touchpoints create a seamless experience. The on-site widget keeps the credit visible when they’re browsing, and your emails and texts are the catalyst to bring them back. This kind of strategic communication ensures your store credit program isn't just a line item in your marketing plan—it's actively working to drive redemptions, increase purchase frequency, and build the kind of long-term loyalty that absolutely crushes churn.

Measuring the Impact on Your LTV and Profitability

Rolling out a native store credit program feels like a big win, but feelings don't prove you're building a healthier business. If you really want to justify the move away from constant discounts, you have to connect your efforts to the metrics that actually drive long-term growth: lifetime value and average order value.

This means looking past the surface-level numbers and focusing on what truly matters. The whole point is to prove you can decrease customer churn while building a more valuable, loyal customer base. We're talking about real, tangible improvements in how often people buy, how much they spend, and how long they stick around.

The Core KPIs That Prove Your Program Is Working

When you ditch confusing points systems and margin-killing coupons for a simple store credit program, you’re making a bet on long-term customer relationships. To prove that bet paid off, you need to track a few key performance indicators (KPIs) before and after you make the switch.

These are the numbers that tell the real story:

Repeat Purchase Rate (RPR): What percentage of your customers have come back to buy again? This is the most direct measure of whether your retention efforts are actually working. Simple as that.

Average Order Value (AOV): How much does the average customer spend per order? A good store credit system should naturally push this number up as people add just one more item to their cart to hit a reward milestone.

Customer Lifetime Value (LTV): This is the holy grail. LTV tells you the total revenue you can reasonably expect from a single customer over their entire relationship with your brand. A rising LTV is undeniable proof you’re creating more loyal and valuable customers.

Don't get lost in a sea of data. If you can show a clear, positive trend in these three core metrics after launching your store credit program, you have all the proof you need that your strategy is a success.

Tracking these numbers gives you a powerful narrative. It’s no longer just about "loyalty"; it’s about building a predictable revenue engine that doesn't need a constant IV drip of costly promotions to survive.

A Simple Framework for Calculating Your ROI

To make your case airtight, you need a clear "before and after" snapshot.

First, establish a baseline. Pull the data for your RPR, AOV, and LTV for the three to six months before you implemented the new store credit system. Think of this as your control group.

Once your program is live, start tracking these same metrics for the cohort of customers who are actively earning and redeeming their credit. Compare the two. The difference is your ROI.

The global retail churn rate is a staggering 37% on average, and for US online retail, it’s 22%. But what we've seen is that simple changes—like making rewards more visible and prompting customers to come back—can have a massive impact. For DTC brands that live and die by LTV, switching from points to native store credit can slash churn by 20-40%. It’s not uncommon for these brands to also report AOV lifts of 15-25% and even see their repeat purchase rates double.

Connecting the Dots to LTV and Profitability

So, how does this all come together to prove you're more profitable? It's a simple, but powerful, chain reaction.

When store credit nudges a customer to increase their AOV, each transaction becomes more profitable. When that same credit program pulls them back for a second or third purchase, your repeat purchase rate climbs.

This one-two punch is what fuels a dramatic increase in LTV. A customer who spends more per order and comes back more often is exponentially more valuable than a one-and-done discount shopper. To really get a handle on this, it's crucial to know how to calculate Customer Lifetime Value for your specific business.

By tracking these KPIs, you can confidently show a clear return on your investment. You're not just giving away credit; you're investing in a system that generates more revenue from every single customer over their entire journey. And that data is the undeniable evidence you need to prove your shift from discounts to store credit is building a more resilient and profitable brand.

Got Questions About Store Credit? We've Got Answers.

Switching from the discount codes you know to a native Shopify store credit system can feel like a big move, even when you see the potential to crush customer churn. It's totally normal to have questions about how it all works. Let's walk through the most common ones we hear from Shopify merchants so you can feel confident this is the right play for your brand.

The big idea here is simple: stop renting loyalty with one-off discounts and start building it with a real, tangible asset for your customers.

Will Customers Actually "Get" It?

Yes, and they’ll probably like it more. Think about it: a $10 store credit is just like cash in their pocket. It’s simple, direct, and valuable. There are no confusing points to calculate or coupon codes to hunt down.

It’s just money waiting for them in their account. That clarity is a huge win. You're removing the mental gymnastics that come with point systems and creating a clean, powerful reason for them to come back and shop. It just feels better.

How Does This Actually Make My AOV Go Up?

This is where the magic really happens, and it’s all about smart psychology. Let's say you offer $10 in store credit for every $100 spent.

Now, picture a customer with an $85 cart. They're so close. That $10 reward is dangling right there, making it incredibly tempting to find one more thing to toss in their cart to get over the $100 line. They’re not just buying; they're actively earning toward their next purchase. This little nudge is one of the most reliable ways to bump up your average order value without slashing your prices.

The best loyalty programs don’t just reward a purchase—they actively shape it. Store credit gives customers a clear, achievable goal that encourages them to spend more, turning a good order into a great one.

Suddenly, shopping becomes a little game where the customer wins by spending a bit more, and you win with a healthier AOV.

Won't Giving Away Credit Destroy My Margins?

This is the big one, but it's where store credit shines. A discount is a direct hit to your margin on the current sale. A 20% off coupon means 20% of your revenue from that transaction vanishes instantly.

Store credit is different. It’s a deferred cost that you only incur on a future purchase.

Here’s why that’s a game-changer for your profitability:

You reward full-price buys: Credit is earned after a customer pays full price, so you protect your margin on that first sale.

It forces a repeat visit: The credit only has value when the customer comes back to spend it—something a discount code never guarantees.

They almost always spend more: When someone comes back to use their $10 credit, they rarely buy a $10 item. They see it as a head start on a bigger purchase, creating a brand new, profitable sale for you.

This turns a potential cost into an engine for repeat business and higher LTV. It’s just a smarter, more sustainable way to grow.

What If Customers Never Use Their Credit?

Some credit will definitely go unredeemed—this is called breakage in the industry. But with a smart program, you can keep this to a minimum. Automated reminders through email and SMS, plus a simple on-site "wallet" that shows their balance, keep that credit top-of-mind.

But honestly, the goal isn't 100% redemption. The credit's main job is to create a strong psychological tether that pulls customers back to your store. Even if a small amount of credit goes unused, the program has already won by boosting AOV on the first purchase and making customers feel more connected to your brand.

We've found that merchants have a lot of the same initial questions when considering this strategy. Here’s a quick-glance table to help.

FAQ Quick Reference

Question | Short Answer |

|---|---|

Is store credit better than points? | Yes. It's simpler for customers to understand—it feels like cash, not a math problem. |

Does it require a lot of manual work? | No. Platforms like Redeemly automate earning, reminders, and redemption within Shopify. |

Can I control the reward rules? | Absolutely. You can set thresholds (e.g., "$10 for every $100 spent") to protect your margins. |

Will this work for my industry? | Yes. It's effective for any DTC brand with repeat purchase potential, from fashion to CPG. |

Hopefully, that clears things up! The move to store credit is less about a new tactic and more about a new mindset—one focused on long-term value over short-term sales.

Ready to stop the discount death spiral and build a more profitable, loyal customer base? Redeemly makes it simple to launch a native Shopify store credit program that boosts AOV, increases LTV, and gives your customers a real reason to come back.

Join 7000+ brands using our apps