Increase Customer Loyalty by Replacing Discounts with Store Credit

Jan 16, 2026

|

Published

The endless cycle of discount codes and confusing point systems is a race to the bottom. Let's be honest, it rarely builds real, lasting customer loyalty. Instead of creating repeat buyers, these tactics just train customers to wait for the next sale, slowly chipping away at your margins and hurting your brand's lifetime value.

But what if there was a better way? A powerful alternative is right at your fingertips: Shopify native store credit. This is how you shift your focus from one-off transactions to sustainable growth driven by higher average order value (AOV) and lifetime value (LTV).

Why Your Discount Strategy Is Hurting Your Brand

Relying on constant discounts feels like running on a treadmill, doesn't it? You're working like crazy just to stay in the same place. This approach attracts bargain hunters, not brand advocates, creating a customer base that will vanish the second a competitor dangles a slightly better deal.

This cycle directly torpedoes your brand's financial health and lifetime value. Every “20% OFF” coupon immediately slashes your revenue, making it harder to invest back into the business—in better products, better marketing, and better service. We break down the real financial impact in our guide on how to improve profit margins.

Ultimately, discounting doesn't build a genuine connection; it just buys a transaction.

The Problem with Points and Discounts

Complex loyalty programs built around points often create more confusion than excitement. Nobody wants to do mental math to figure out what "200 points" actually means in real dollars. That friction is a killer for engagement and does little to increase lifetime value or drive the repeat business you're after.

It’s time for a system that feels tangible, valuable, and directly integrated into the Shopify experience.

Think about it: loyalty programs that offer cash-like rewards just perform better. Hard data shows 68% of customers make repeat purchases more frequently when rewards feel like real money. This simple shift to a native Shopify store credit model can lead to a 25% uplift in customer lifetime value (LTV) within the first year alone.

Shifting to a Profit-Safe Model

This is where native Shopify store credit completely changes the game. Instead of giving away your margin upfront with a discount, you reward customers with credit they can use on a future purchase.

This simple change has a massive impact on your key growth metrics:

It protects your margins. You only incur a cost when a loyal customer actually returns to spend again.

It boosts LTV. It gives customers a concrete, dollar-based reason to come back, directly increasing their lifetime value.

It increases Average Order Value (AOV). Shoppers are often motivated to spend a little more to earn even more credit for next time.

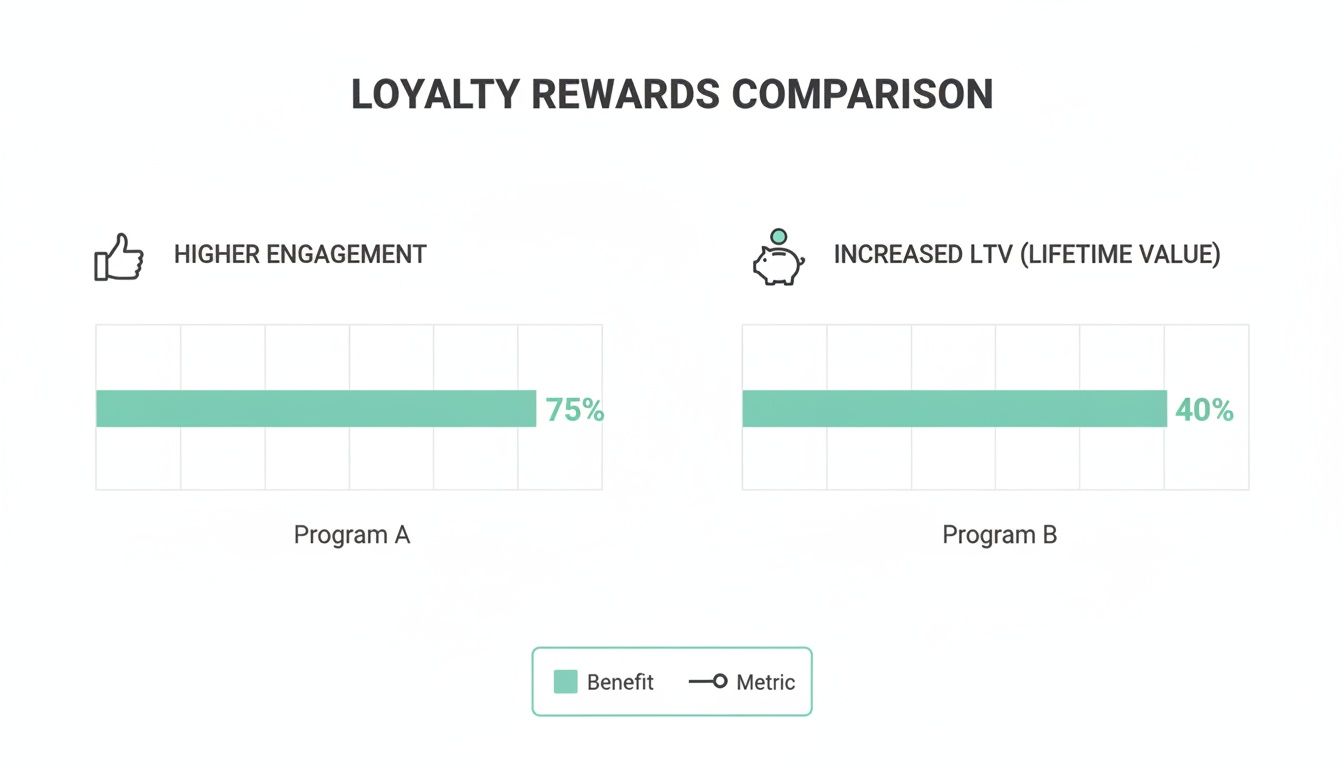

When you put these two models side-by-side, the advantages of native Shopify store credit become crystal clear.

Discount Codes vs. Store Credit: A Head-to-Head Comparison

Here’s a direct comparison of how these two approaches impact your key business metrics.

Metric | Traditional Discount Codes | Native Shopify Store Credit |

|---|---|---|

Margin Impact | Immediate, upfront margin loss on every transaction. | Margin is protected; cost is only incurred on a future repeat purchase. |

Customer LTV | Attracts one-off deal seekers, often leading to lower lifetime value. | Encourages repeat purchases, directly increasing customer lifetime value. |

Purchase Behavior | Trains customers to wait for sales before buying. | Motivates customers to return and spend their earned credit, often adding more to their cart, increasing AOV. |

Brand Perception | Can devalue your brand and products over time. | Builds a premium brand image by rewarding loyalty instead of discounting. |

Customer Engagement | Low engagement; customers only interact when there's a sale. | Higher engagement as customers track and use their "cash-back" balance within their native Shopify account. |

The takeaway is simple: moving from reactive discounting to a proactive store credit model isn't just a small tweak—it's a fundamental shift in how you build a loyal and profitable customer base with a higher lifetime value.

The data speaks for itself. Tangible, cash-like rewards are a far superior strategy for building a business that lasts.

Designing Your Store Credit Loyalty Program

Alright, let's get into the nuts and bolts. Moving from the old-school discount model to a native Shopify store credit system is a game-changer, and how you design the program is everything. The real goal here is to build something that feels wildly generous to your customers but secretly works like a charm for your bottom line. We're ditching the confusing points systems that nobody understands. Instead, we’re focusing on simple, cash-like rewards that actually boost AOV and LTV.

The best programs are dead simple. A structure like "Spend $100, get $10 in store credit" is a no-brainer. Everyone gets it instantly. That clarity is the secret sauce for getting customers on board and increasing customer loyalty because you're removing any mental friction. They see a clear, dollar-for-dollar reward for spending, which feels way more valuable than some abstract point total.

Finding Your Sweet Spot

Now for the million-dollar question: what’s the right reward to offer? This isn't a one-size-fits-all number. You have to find that sweet spot where the offer is juicy enough to motivate a purchase but doesn't wreck your margins.

Here’s how to find your magic number:

Look at Your Average Order Value (AOV). Seriously, pull up your data. If your AOV is sitting at $85, setting a reward tier at the $100 mark is a fantastic little nudge. It’s a simple psychological trigger that encourages shoppers to toss one more item in their cart, giving you an immediate AOV lift.

Be Honest About Your Margins. The math has to work. A 10% cash-back rate (spend $100, get $10) is a solid starting point for many, but if you're working with tighter margins, you'll need to adjust. Your unit economics are your guide here.

Don't Overcomplicate It. Fight the urge to launch with a multi-tiered, complex program. Start with one crystal-clear offer. See how it impacts your AOV and repeat purchase rate, and then you can think about adding more layers down the road.

Here's the key thing to remember: the cost of store credit only hits your books when a customer comes back to spend it on a second purchase. This turns your loyalty program into a self-funding retention machine, tying the expense directly to a higher lifetime value.

Making Your Program Impossible to Ignore

Look, you could have the best loyalty program in the world, but if nobody knows it exists, it's worthless. This is where on-site messaging becomes so critical. You have to weave it into the shopping experience so seamlessly that it’s impossible to miss from the moment someone lands on your site. For some great foundational tips, check out this guide on creating a customer-friendly website.

Visibility isn't about annoying pop-ups. It's about putting the right message in the right place at the right time, guiding the customer and encouraging a higher AOV.

Proven On-Site Messaging Tactics

I’ve seen these tactics work time and time again on Shopify stores:

The Floating Wallet Widget: This is a small, persistent widget that stays on the screen, showing logged-in customers their current credit balance. It’s a constant, gentle reminder of the "free money" they have waiting for them.

Dynamic Product Page Banners: Imagine a small banner right on the product page that says, "Spend $100 and get $10 back in credit!" It puts the reward right in front of them as they're making a buying decision.

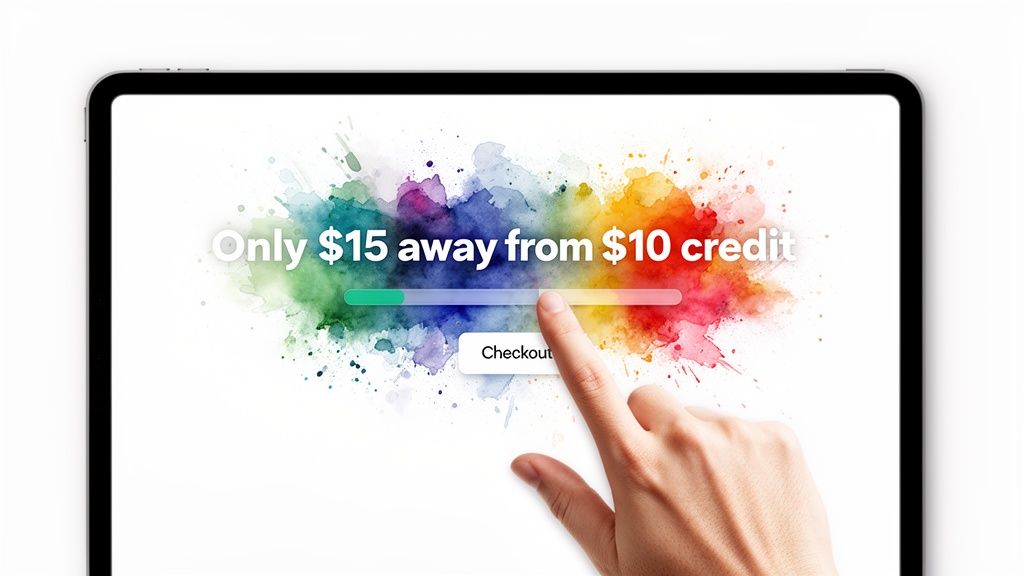

Interactive Cart Messaging: This one is powerful for boosting AOV. As someone adds items to their cart, a message updates in real-time: "You're only $23 away from earning $10 in credit." It gamifies the experience and is often the final push needed to bump up that order size.

When you automate the credit delivery after a purchase and make the rewards super visible, you create a beautiful, frictionless loop. Customers get rewarded instantly, they see their balance, and they're constantly reminded to come back and spend it. That’s how you drive up both LTV and AOV.

How to Get Customers to Actually Use Their Store Credit

Alright, your native Shopify store credit program is up and running. But let's be honest, just handing out credit isn't enough. The real magic happens when you actively get customers to come back and spend it. This is where you turn a one-time buyer into a loyal fan and see a direct impact on your customer lifetime value.

Your job is to create automated campaigns that feel less like a sales pitch and more like a helpful heads-up. A well-timed email or SMS is often the only nudge someone needs. By reminding them they have "cash on file" in their Shopify account, you're giving them a powerful reason to shop again—one that doesn't involve slashing your margins with yet another discount code.

This isn't just a nice-to-have; it's essential for increasing lifetime value. A recent report found that a whopping 64% of shoppers don't even pay attention to brand names anymore. To stand out, you have to build a real relationship. That same report showed 55% of customers stick around when they feel an emotional connection, and a well-managed credit program is a perfect way to build that bridge. You can dig into all the findings of the Customer Loyalty Index for more on that.

Build the "Your Credit Is Waiting" Flow

One of the most powerful plays you can run is the automated "credit reminder" flow. It’s a simple email and SMS sequence that triggers a set time after a purchase, reminding customers about the value they've earned.

I’ve found that setting this flow to trigger 30 days after their purchase hits the sweet spot. It’s enough time for the novelty of their last order to wear off, but not so long that they’ve forgotten about you.

Here's a simple, effective email template to get you started:

Subject: You've Got $[Credit Balance] Waiting For You!

Hey [Customer Name],

Hope you're loving your recent order!

Just wanted to give you a heads-up that you have $[Credit Balance] in your account, ready to go for your next purchase. Think of it as a little thank you on us.

Why not treat yourself to something new?

[Button: Shop New Arrivals]

See how that works? The message is direct, personal, and focuses entirely on the value they already have. It reframes the credit as a tangible asset, which makes browsing your latest collections a no-brainer.

Get Smart with Segmentation and Personalization

Generic email blasts are a waste of time. If you really want to increase customer loyalty and lifetime value, you have to get personal and segment your audience. Showing customers you get them is what builds that deeper connection.

Try running with these segmentation strategies. They work wonders:

Segment by Credit Balance: Pull a list of everyone with a credit balance over a certain amount—say, $20 or more. Send them a campaign highlighting some of your best-sellers or curated bundles they can grab with a significant "discount" by using their credit.

Segment by Purchase History: Did a customer just buy a specific type of product, like a skincare set? The moment new items drop in that category, hit them with an email. Frame it like this: "Use your $[Credit Balance] to grab the latest in [Product Category]!"

Segment by Inactivity: Go after customers who earned credit but haven't been back in 60 or 90 days. A simple, "Hey, don't let your credit expire!" can be incredibly effective at waking up a dormant shopper.

When you pair smart automation with even smarter segmentation, you create a self-sustaining engine that keeps driving repeat sales. This is how you transform casual buyers into your most valuable, high-LTV customers.

Using Store Credit to Boost AOV and Conversion

Most merchants think of store credit as a tool for post-purchase loyalty—a nice little bonus to thank a customer after they’ve already bought something. But that's only half the story. The smartest brands use native Shopify store credit as an active, on-site sales driver that boosts average order value in the moment.

Think about it. A generic discount code feels promotional, but store credit feels like real money just waiting to be spent. It’s tangible. When a shopper sees they can earn actual cash back for their next order, it creates a powerful psychological nudge to spend a little more right now. This flips your loyalty program from a passive retention tool into a dynamic AOV and conversion machine.

Turning Browsers into Bigger Buyers

The trick is to make the reward impossible to ignore. You want to gamify the shopping experience by dangling an achievable goal right in front of your customers as they browse. This isn't just about offering a reward; it's about creating a mini-challenge for them to complete that directly increases your average order value.

This approach is incredibly effective because it taps into a customer's desire for a great deal without forcing you to slash prices upfront. We’ve seen this work wonders for brands, and you can dig deeper into these kinds of strategies in our full guide on how to increase average order value.

By framing the reward as something to be "unlocked," you shift the shopper's mindset. They stop thinking, "How can I save a few bucks?" and start asking, "How can I earn that credit?" This subtle change is everything when it comes to motivating bigger carts and a higher AOV.

High-Impact Messaging Placements

To pull this off, your store credit offer can't be hiding on some forgotten loyalty page. It needs to be woven directly into the fabric of the shopping journey, right where decisions are being made.

I’ve found these three placements to be absolute goldmines for boosting AOV:

Product Page Banners: As someone is eyeing a product, hit them with a message like, “Add this to your cart and you're halfway to earning $10 in credit!” It immediately frames the purchase as progress toward a reward.

Dynamic Cart Notifications: This is where the real magic happens for AOV. As a customer adds items, a banner in the cart or a slide-out drawer should update in real-time. “You’re just $15 away from earning $10 in store credit!” The sense of urgency is palpable.

Checkout Page Reminders: Even at the final hurdle, a gentle nudge can be surprisingly effective. A simple reminder can prompt a customer to pop back and add one more small item to their cart to hit that reward threshold.

When you start implementing these tactics, your store credit program stops being just a cost center and becomes a genuine engine for growth. It actively encourages customers to cross those spending thresholds, driving up your AOV and turning one-time browsers into your best, most loyal buyers with the highest lifetime value.

Measuring What Actually Matters: The ROI of Your Loyalty Program

So you've launched a native Shopify store credit program. That’s a fantastic first step. But the real victory isn’t in just having a program—it’s in knowing, with certainty, that it’s increasing your lifetime value and average order value. A loyalty program is only as good as the results it brings in, which means it’s time to stop guessing and start measuring.

Tracking the right metrics is how you prove ROI to yourself and your team. More importantly, this is the data that will help you fine-tune your program and make it even more profitable over time.

Forget vanity metrics like signup rates. We need to go deeper and look at the numbers that directly impact your bottom line: LTV and AOV. These are the core KPIs that show the real health of your customer relationships and tell you if your efforts to increase customer loyalty are paying off.

The Big Three Metrics That Will Tell You Everything

When you shift from random discounts to a strategic store credit system, the way you measure success has to change, too. You're no longer just counting how many coupon codes were used; you're now tracking the long-term, profitable behaviors of your best customers.

Here are the only three KPIs you really need to obsess over:

Customer Lifetime Value (LTV): This is the holy grail. LTV tells you the total profit you can expect from a customer over their entire relationship with your brand. A rising LTV is the single clearest signal that your store credit program is creating more valuable, long-term fans.

Repeat Purchase Rate: This one is straightforward—it’s the percentage of customers who come back to buy again. A well-designed store credit program should give this number a serious boost, directly fueling a higher LTV.

Average Order Value (AOV): We've talked about how store credit nudges shoppers to add just one more item to their cart to hit a reward threshold. By tracking AOV before and after you launch your program, you’ll see its immediate impact on how much people spend per order.

Digging into these key user retention metrics gives you a complete, unvarnished look at how your program is performing. This is the difference between hoping for loyalty and actually engineering it for higher lifetime value.

Using Shopify Analytics to Find Your Proof

You don't need a fancy, expensive BI tool to get started. Most of the data you need is already sitting inside your Shopify dashboard, just waiting for you. By setting up a few simple cohort reports, you can get a crystal-clear picture of your program's impact on LTV and AOV.

The whole game is about comparing the behavior of customers who use your store credit program against those who don't. That comparison is your proof. When you can show that loyalty members have a 30% higher LTV and a 15% higher AOV, you've just validated your entire strategy.

For example, pull a cohort analysis of all customers who made their first purchase last May. Then, track their spending and how often they came back over the next three, six, and twelve months. Now, do the same for a cohort from before you launched your credit system. The difference in LTV and AOV will tell the entire story.

Tweaking Your Program with Simple Tests

Measurement isn't just about a report card; it's about getting better. Once you have your baseline numbers for LTV and AOV, you can start running simple A/B tests to make your program even more powerful. Nothing is set in stone.

Here are a few ideas to get you started:

Reward Tiers: Test offering "$10 credit for every $100 spent" against "$15 for every $125 spent." See which one gives you a better lift in AOV without squeezing your margins.

On-Site Prompts: Try different banner copy. Does "You're just $15 away from your reward!" convert better than "Spend $15 more to unlock $10 in credit"?

Email Reminders: Experiment with the timing of your "you have credit to spend" emails. Send one at 30 days and another at 45 days post-purchase to see which window drives more repeat sales and a shorter time between purchases.

When you constantly measure and test, you turn your loyalty program from a static feature into a dynamic growth engine that gets smarter over time. This data-driven approach is the secret to building a wildly profitable loyalty strategy that keeps your best, high-LTV customers coming back again and again.

Common Questions About Store Credit Loyalty

I get it. Moving away from the discount treadmill to a native Shopify store credit model can feel like a big leap. Whenever I talk to Shopify merchants about making this switch, the same practical questions always come up.

The good news? This approach is simpler, more profitable, and far better for driving long-term growth through higher LTV and AOV than you might think. Let's tackle the most common concerns head-on.

Will Store Credit Be Too Expensive for My Business?

This is probably the biggest myth I have to bust. The truth is, a native Shopify store credit program is far more margin-safe than handing out discount codes like candy.

Think about it: a 20% off coupon is an immediate, guaranteed hit to your revenue on that sale. It doesn't matter if that customer ever comes back—you've already given away your margin.

Store credit, on the other hand, only becomes a "cost" when a customer proves their loyalty by returning to make a second purchase. You’re tying your loyalty spend directly to future revenue. It flips the script, turning a marketing expense into a powerful engine for repeat business and a much healthier lifetime value.

Is It Difficult to Switch from My Current Points App?

Not at all. In fact, it's a huge relief for most merchants. Migrating to a native Shopify store credit system is incredibly straightforward because it's built on Shopify's own foundation. There are no heavy scripts to slow down your site or clunky third-party integrations to manage. The whole setup is quick and painless, no developers needed.

The customer experience is also dramatically better. They see and manage their store credit right inside their native Shopify account, and it’s a one-click apply at checkout. This completely removes the friction of external widgets or confusing calculators for converting points to dollars, which is a huge win for increasing customer loyalty.

The real value is in its simplicity. A customer sees "$10 in your account" and instantly understands the value. There's no mental math, no converting points—just clear, tangible value that motivates them to shop again and boosts lifetime value.

How Do I Convince Customers to Value Store Credit Over Discounts?

It all comes down to how you frame it. You have to position store credit as what it actually is: real, cash-like value. It's not a coupon; it’s money in their pocket, waiting to be spent at your store.

This means being consistent with your messaging.

Use a clear, dedicated loyalty page explaining the perks.

Showcase their balance in a floating wallet widget on every page.

Send post-purchase emails reminding them they have "cash to spend."

When the value is tangible and always visible, it becomes a powerful motivator.

Unlike fleeting discount codes that train customers to wait for sales, store credit feels like a persistent reward they've earned. This simple shift builds a much stronger emotional connection and a higher lifetime value, making them far less likely to be tempted by a competitor's next 15% off coupon.

Ready to turn one-time buyers into profitable, long-term fans? With Redeemly, you can launch a native Shopify store credit program that protects your margins, boosts AOV and lifetime value, and builds a predictable revenue base. See how Redeemly works.

Join 7000+ brands using our apps