Loyalty Programs Shopify: How Store Credit Boosts LTV and AOV

Feb 1, 2026

|

Published

Shopify loyalty programs are supposed to reward your best customers, but many end up being a drag on profitability. Merchants often fall into the trap of using discount coupons and confusing point systems that just eat into their margins. The smartest play? Focus on Shopify native store credit. It acts like cash in your customer's account, encouraging them to spend more and stick around longer, ultimately boosting lifetime value (LTV) and average order value (AOV) without constantly slashing your prices.

Why Your Current Loyalty Program Is Costing You Money

Many loyalty programs feel like a race to the bottom. You dangle discounts to get people to buy, but every sale just shaves off a piece of your profit. Soon, you're known as the "deal" brand, not the "quality" brand, and your customers are conditioned to wait for the next 20% off coupon. It’s a vicious cycle that erodes brand value and isn't sustainable for long-term growth.

The root of the problem is that these programs are built for short-term, transactional perks instead of fostering a real, lasting connection that increases customer lifetime value.

The Leaky Bucket of Discounts

Think of your business as a bucket you’re trying to fill with revenue. Every discount and coupon code is another hole in the bottom. Each time a customer applies a 20% off code, a little more of your hard-earned cash drips out. It might secure that one sale, but over time, it drains your profitability.

This creates a dangerous mindset. Customers begin to see discounts as a standard part of the deal, which undermines your product's actual worth. You’re not building loyalty; you’re just renting it one transaction at a time. The focus shifts from the quality of your products to who has the better coupon, which is a losing game for any brand focused on lifetime value.

When Points Create Confusion, Not Loyalty

What about points? They seem like a solid alternative, but they bring their own headache. Complicated rules—"Earn 10 points for every $1 spent, redeem 1,000 points for $5 off"—force your customers to do mental gymnastics just to figure out what their loyalty is even worth.

That kind of complexity just leads to frustration. If a rewards system is a puzzle, people aren't going to stick around to solve it. This confusion kills engagement and prevents the program from driving repeat purchases and increasing LTV.

I saw this happen with a Shopify merchant selling high-end skincare. They had an elaborate, tiered points program, but their data revealed a huge problem: people were earning points but almost no one was redeeming them. Customers were confused by the tier benefits and redemption process, so they gave up. If you want to dive deeper, we have a guide on the pros and cons of different loyalty program tiers.

For that skincare brand, the program wasn't building loyalty. It was just creating a pile of unused points that sat on their books as a financial liability. It was all cost and zero return in terms of lifetime value. This is an incredibly common pitfall for so many Shopify loyalty programs.

The bottom line is that both discounts and points can devalue your brand and overcomplicate things. There's a much better way to go about it—one that’s simple, directly boosts LTV and AOV, and actually helps your business grow profitably.

Store Credit: The Future of Shopify Loyalty Programs

For years, loyalty programs have been stuck in a rut of margin-killing discounts and confusing points systems. But what if there was a better way? A more direct, intuitive, and profitable approach is quickly becoming the new standard for brands focused on lifetime value.

Imagine giving your best customers their own dedicated ‘brand wallet’—a place where they can save up and spend real, tangible value with every purchase. That’s the magic of shifting from abstract points and fleeting discounts to a loyalty program built on Shopify native store credit.

This simple switch completely changes how customers perceive your rewards. A coupon code feels temporary and transactional. Store credit, on the other hand, feels like something they’ve earned. It's real money that belongs to them, just waiting to be spent at your store, which creates a powerful psychological sense of ownership that drives both higher AOV and LTV.

Protect Your Profits While Building Real Loyalty

One of the biggest wins for store credit is how it protects your profit margins. A discount immediately slashes the revenue from a sale. Store credit is different—it's only realized as a cost when the customer comes back to redeem it on a future purchase. This delay is a game-changer for your cash flow and financial health.

Better yet, there's the "pull effect" of an unspent balance. Think about it: a customer with $10 of store credit is far more likely to return than someone who used a 10% off coupon and forgot about it. That balance is a constant, gentle nudge, encouraging that all-important second or third purchase—the key to increasing customer lifetime value.

Store credit bridges the gap between a simple transaction and a meaningful relationship. It’s not just a discount; it’s a promise of future value that keeps your brand top-of-mind and drives repeat business.

This creates a much healthier, more sustainable growth loop. Instead of burning cash on expensive acquisition campaigns, you're investing in the customers you already have. You're actively boosting their lifetime value (LTV) and turning them into a reliable, predictable source of revenue.

Why Store Credit Outperforms Other Models

When you put store credit head-to-head with discounts and points, the winner for merchants focused on lifetime value and profitability becomes crystal clear. It makes the experience simpler for your customer and delivers far better financial outcomes for your business. All the mental gymnastics of "earn X points for Y dollars" disappear, replaced by a simple, cash-like value anyone can understand.

Let's break down exactly why store credit is the superior model for Shopify merchants who care about building a lasting, profitable brand.

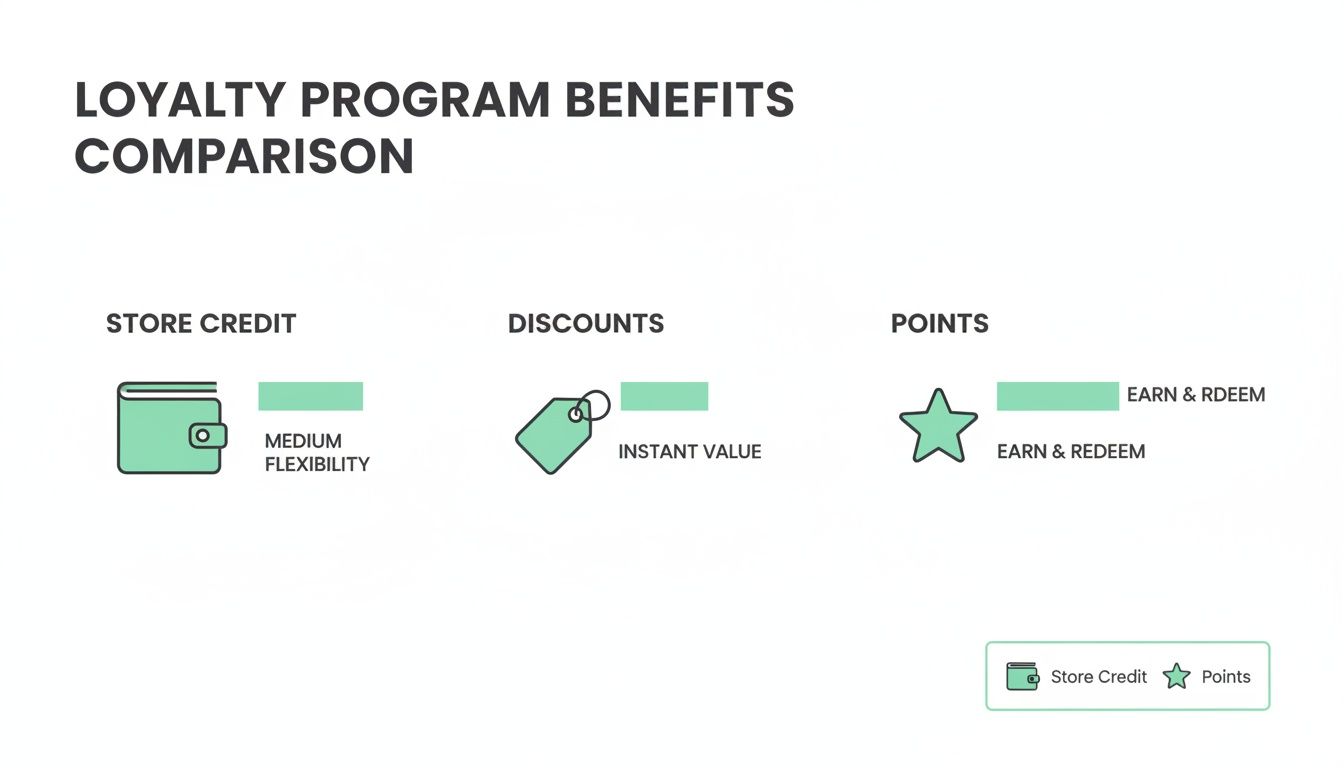

Store Credit vs Discounts vs Points: A Comparison

The table below gives a head-to-head comparison. It shows why store credit is the smartest choice for Shopify merchants who want to increase profitability, customer lifetime value, and average order value—not just offer another coupon.

Feature | Store Credit Programs | Discount-Based Programs | Points-Based Programs |

|---|---|---|---|

Customer Psychology | Feels like earned cash; creates a strong desire to spend it. | Feels transactional and temporary; can devalue your products. | Often confusing; requires mental math to figure out the value. |

Profit Margin Impact | Cost is only realized upon redemption on a future purchase. | Immediate reduction in revenue and margin on the initial sale. | Cost is a future liability that can be difficult to forecast accurately. |

Simplicity | Dead simple for customers to understand and use. No calculator needed. | Simple, but requires constant promotion and management to be effective. | The most complex system, which often leads to customer frustration. |

Impact on AOV | Encourages customers to spend more to use up their balance. | Encourages buying only the discounted item, often lowering AOV. | Can encourage adding more to the cart, but the value is less direct. |

Customer Retention | Creates a powerful incentive to return and spend their earned balance. | Creates loyalty to the discount, not necessarily to your brand. | Can work for retention, but only if the system is extremely clear. |

At the end of the day, store credit perfectly aligns your business goals with your customers' desires. They get clear, tangible value for being loyal, and you get to build a more profitable, resilient business founded on genuine relationships that increase customer lifetime value.

How Store Credit Drives Lifetime Value and Average Order Value

Let's be honest, the real magic happens when your loyalty strategy starts moving the needle on your most important growth metrics. For any Shopify merchant, that almost always boils down to two things: Customer Lifetime Value (LTV) and Average Order Value (AOV). This is where store credit truly shines, outperforming confusing points systems and margin-crushing discounts by boosting both at the same time.

It all starts by reframing the customer experience. Instead of a one-and-done transaction, you create a rewarding cycle. When your customers know that spending a little more unlocks a bigger, tangible reward that feels like cash, their whole shopping mindset changes. Suddenly, the purchase becomes a bit of a game, nudging them to pop just one more item into their cart to cross that next reward threshold.

This is a simple but powerful psychological trigger for bumping up your AOV. A customer might be perfectly happy with a $75 cart, but if they see a notification that hitting $100 gets them $10 back in store credit, that extra $25 spend feels less like an expense and more like a smart investment for their next shopping trip.

Here's a quick look at how the different loyalty program types really stack up when you focus on what matters to a Shopify merchant.

As you can see, store credit hits that sweet spot. It offers real, understandable value while building a powerful reason for customers to come back for more.

The Magnetic Pull of an Unspent Balance

Once a customer has that store credit in their account, a powerful retention engine kicks into gear. Think of an unspent balance as a magnet. It creates a subtle but persistent "pull effect" that draws them back to your store. This isn't just wishful thinking; it's grounded in real human psychology.

An unspent store credit balance creates a sense of unfinished business. It’s not a coupon that can be lost or forgotten—it’s perceived as their money, waiting to be used. This drives a powerful and organic motivation for a repeat purchase, directly increasing LTV.

This cycle is exactly how you turn casual, first-time buyers into your most valuable, loyal fans. The numbers back this up in a big way. One study of over 100 Shopify brands revealed that customers who redeem rewards have an incredible 65% repeat purchase rate. For customers who don't redeem, that number plummets to just 12.3%. Even better, engaged loyalty members generate 115% more revenue per customer, completely changing the economics of your customer base.

A Customer Journey Fueled by Store Credit

Let’s make this real. Here’s how this profitable cycle plays out for a typical customer.

Meet Sarah, a first-time buyer:

First Purchase: Sarah finds your brand and places her first order for $80. Your program instantly gives her $8 back (a 10% reward). This feels like a genuine thank you, not some flimsy coupon code she'll forget about.

The Nudge to Return: A week later, a simple email lands in her inbox: "You still have $8 in your brand wallet!" That $8 is a constant, low-pressure reminder of your store. She already liked her first order, and now she has a very real reason to come back and browse.

The Second, Larger Purchase: Sarah returns to your site. She finds something she loves for $50, and at checkout, her $8 credit is already there waiting for her. But she also sees she's only $25 away from earning another $10 in credit. So, what does she do? She adds a $30 accessory to her cart. Her new total is $80, and she now has another $8 in credit lined up for her next purchase.

Look what happened here. Store credit didn't just secure a second sale—it actively made that sale bigger. Sarah's AOV on her second purchase was higher than her first, and the whole cycle is ready to repeat itself, boosting her LTV with every transaction.

This is how you create a self-sustaining loop of value for both you and your customers. You build a foundation of repeat buyers who spend more each time they shop, which is the surest path to increasing their lifetime value. If you're looking for more strategies on this front, it's worth exploring these proven tactics on how to increase Customer Lifetime Value. This focus on sustainable, profitable growth is what makes store credit the smartest loyalty play in the game.

Getting a Native Store Credit Program Running in Shopify

So, you're ready to ditch confusing points and margin-killing discounts? Good. Moving to a store credit program that feels like a natural part of your Shopify store is way easier than you might think. The key is to leverage Shopify's native functionality to drive lifetime value and average order value.

The magic word here is native. This isn't just marketing fluff. A native program is built right on top of Shopify’s own framework, which means no clunky widgets slowing your site down and no weird, disconnected experience for your customers. It just works, smoothly and reliably, making the whole thing feel like an effortless perk, not some tacked-on program.

Picking a Native App and Setting Up Your Rewards

First things first, you’ll need a loyalty app that’s built to use Shopify’s own store credit system. Some apps try to create their own separate wallet, but a truly native app plugs right into Shopify’s core. This is a game-changer because your customers' store credit balance lives inside Shopify, giving both you and your shoppers one simple, accurate number to trust.

Once you have your app, it’s time to set the rules. The whole point is to make your rewards simple and directly tied to increasing AOV and LTV.

Here are a few popular ideas to get you started:

Simple Cashback: This is a crowd-pleaser. Offer a percentage of every order back as store credit. Something like, "Get 10% back on everything you buy!" is easy to grasp and a great incentive to spend more.

Spend More, Get More: Want to bump up that Average Order Value? Set up tiers. For example, "Spend $100, get $10 back. Spend $150, we’ll make it $20!"

Smart Referrals: Turn your best customers into your best marketers. A classic rule is, "Give a friend $10 off their first order, and get $10 in credit for yourself when they make a purchase."

Of course, a loyalty program works best when your store itself is already running like a well-oiled machine. If you're just starting out, this guide on setting up a Shopify store is a fantastic resource.

Creating an On-Site Experience People Love

How you present your program is just as important as the rewards themselves. Because a native app is woven directly into your theme, you can create touchpoints that feel genuinely helpful, not intrusive.

The best loyalty programs don’t feel like programs at all. They feel like a natural part of the shopping experience—an effortless perk for being a valued customer.

Think about adding a floating wallet icon that follows your customer around the site, always showing their available balance. It’s a subtle but powerful reminder of the value they’ve earned, nudging them closer to another purchase. You can also place banners on product pages showing exactly how much credit they’d earn if they bought that specific item. Suddenly, every product view is a new opportunity.

For a deeper dive into the nuts and bolts, check out our step-by-step guide on how to issue store credit on Shopify.

Moving Over From an Old Points System

Switching from points to store credit can feel like a delicate operation. You’ve got to make sure your most loyal customers feel upgraded, not ripped off. A bungled migration can undo years of customer goodwill, so clear communication is everything.

Here’s a simple playbook to make the transition a win:

Do the Math: First, figure out the real-world dollar value of everyone's points. If 1,000 points equals $10, you need to calculate that for every single customer.

Give a Heads-Up: Start sending out emails well in advance. Frame the change as a big improvement. Think: "We're making our rewards simpler and more valuable!" and spell out exactly why store credit is better for them.

Flip the Switch: On launch day, convert every last point into its store credit equivalent. That customer with 1,500 points worth $15? They should log in and see a fresh $15 store credit balance waiting for them.

Announce the Launch: Send one last email letting everyone know the new, better program is live. Reassure them that their old points are safe and have been converted into flexible store credit, ready to use whenever they want.

Best Practices for a High-Performing Store Credit Program

Getting your Shopify store credit program live is a huge first step. But the real magic happens when you weave it into the very fabric of your brand. A truly great loyalty program isn't just another feature; it becomes a core part of your customer communication and the entire shopping experience, laser-focused on increasing LTV and AOV.

The trick is to frame your program not as some complex, points-based system, but as a simple, valuable perk. When customers realize they're earning real, cash-like value with every purchase, their entire relationship with your brand starts to change for the better.

Frame Store Credit as Cash for Your Store

How you talk about your program is everything. Ditch the confusing jargon and focus on clarity and immediate value. The most powerful messaging frames store credit as a tangible asset—something your customers actually own and can spend whenever they want.

Use simple, direct language across every channel:

On-site Banners: Instead of a generic "Join Our Rewards," try something punchy like "Get 10% Back on Every Purchase."

Email & SMS: Make it personal and exciting. "You've earned $15 in store cash!" or "Your brand wallet is waiting for you" works wonders.

Product Pages: Show the benefit right where they’re making a decision: "Buy now and get $7.50 back in credit."

This approach completely removes the mental math of points. The benefit is obvious and immediate, which is a powerful nudge to spend more and come back soon.

Promote Your Program at Every Key Touchpoint

If you want your loyalty program to work, you can't hide it. Don’t just tuck it away on a single "Rewards" page and hope people find it. Instead, integrate it into the entire customer journey to constantly reinforce its value.

Think about all the key moments to highlight the perk:

Homepage: Greet new visitors with a clear, compelling banner that introduces the program.

Product Pages (PDPs): Show customers exactly how much store credit they'll earn on that specific item.

Cart & Checkout: Remind shoppers of the credit they’re about to earn. It's a great way to reduce cart abandonment.

Post-Purchase Flow: The moment the sale is complete, confirm the credit they’ve earned in the order confirmation email and on the thank-you page.

This multi-touchpoint strategy makes sure your program is always top-of-mind, turning it from a background feature into an active driver of sales.

By making your program an integral part of the shopping experience, you transform it from an afterthought into a compelling reason to choose your brand over a competitor. It becomes a value-add that strengthens every transaction.

Go Beyond Loyalty with Smart Credit Applications

While boosting LTV is the main goal, store credit is an incredibly flexible tool that can solve other common ecommerce headaches. Using it strategically in customer service can flip a potentially negative experience into a moment of brand delight.

Take returns, for example. When a customer needs to send something back, offering an instant store credit refund is often way faster and more appealing than a slow bank refund. This keeps the cash in your business and gives the customer a strong reason to find another product they’ll love.

You can even sweeten the deal by offering a small bonus—like an extra $5 in credit—for choosing that option. Suddenly, a return becomes a win-win. This builds incredible goodwill and shows you value their business, even when a purchase doesn't work out.

The impact of these retention strategies is massive. According to Shopify experts, a tiny 5% increase in customer retention can boost profits by a staggering 25%. DTC brands with smart loyalty programs often see their retention rates jump by 20-30%. The data is clear: these investments pay for themselves by fundamentally improving your profitability. You can find more insights on how loyalty programs impact Shopify store setup and success on blackbeltcommerce.com.

Your Top Questions About Shopify Store Credit, Answered

Making the jump to a new loyalty strategy always brings up a few questions. I get it. Moving away from the familiar world of points and discounts can feel like a big step, even if it's a smart one. But embracing a store credit program built right into Shopify is one of the most profitable moves you can make.

Let's clear up the common concerns merchants have so you can move forward with confidence. We'll tackle the big questions around performance, migration, and measuring success, focusing on what really matters: boosting lifetime value without all the usual complexity.

Is Store Credit Really Better Than Points?

This is the big one, and my answer is always a firm "yes"—especially if you value simplicity, profitability, and increasing customer lifetime value.

A points system forces your customers to do mental gymnastics. "Okay, so how many points is a dollar worth? What can I actually get for 500 points?" That friction is a killer. It leads to confusion, and before you know it, your customers have tuned out completely. They might rack up points, but they never actually use them, turning your loyalty program into a dormant liability on your books.

Store credit cuts right through that noise. It's simple. It’s a cash-like value that everyone gets in a split second.

$10 in store credit is $10 they can spend. It's that easy.

This clarity makes the reward feel more real and valuable, creating a much stronger psychological pull for customers to come back and shop again. You're shifting their mindset from "solving a puzzle" to "spending money I earned," which is a far more powerful way to drive repeat business and increase LTV.

How Do I Migrate From an Old Loyalty App?

Moving away from an existing points app can feel intimidating. The last thing you want is to make your most loyal customers feel like their hard-earned rewards just vanished into thin air. But with a bit of planning and clear communication, this transition can be a massive win for your brand.

The process is more straightforward than you might think:

Calculate the Cash Value: First, figure out the exact dollar value of every customer's existing points balance. If your old system valued 1,000 points at $10, do that conversion for every single member.

Communicate the Upgrade: This is key. Frame the change as a positive step up. Send out an email explaining that you're moving to a simpler, more valuable "brand wallet." Emphasize that you're converting their loyalty into real, cash-like store credit.

Make the Switch: On a set date, use your new Shopify-native app to issue store credit balances that perfectly match the dollar value of their old points. That customer with 1,500 points worth $15 should log in and see a $15 credit waiting for them.

Announce and Reassure: Send a final announcement letting everyone know the new, improved program is live. Reassure them that their loyalty has been preserved and is now easier than ever to use.

When you handle it this way, your customers feel valued and upgraded, not left behind.

What’s the Big Deal About a “Native” Shopify App?

The word "native" is incredibly important here. A native store credit app is built directly on Shopify’s own foundation. This is a world away from those third-party widgets that run their own separate systems and inject clunky code into your theme, which almost always slows down your site and creates a disjointed experience for shoppers.

A native Shopify app doesn't just work with Shopify; it works as part of Shopify. The store credit balance is a single, reliable number managed right inside Shopify's core system. That means a seamless experience for you and your customers.

This deep integration gives you some serious advantages:

Speed and Reliability: No heavy external scripts bogging things down. Your site stays fast, and your conversion rates are protected.

Seamless Checkout: Customers can see and apply their store credit directly within the normal Shopify checkout flow. No weird pop-ups, no extra steps.

Rock-Solid Accuracy: There's only one source of truth for every customer's balance. This completely eliminates the sync errors that plague third-party apps.

Simplicity: You manage everything right from your Shopify admin, keeping your workflow clean and efficient.

Choosing a native app makes your loyalty program feel like a premium, built-in feature of your store, not a clunky add-on.

How Can I Measure the ROI of This Program?

This is where store credit really shines. Measuring the return on investment (ROI) is far more direct than with points or discounts because the entire goal is to drive tangible growth metrics like LTV and AOV.

Start by tracking these key performance indicators (KPIs) before and after you launch:

Repeat Purchase Rate: This is the ultimate measure of loyalty. Are more customers coming back for a second, third, or fourth purchase after earning credit?

Average Order Value (AOV): Keep an eye on whether customers are spending more per transaction, either to hit a reward threshold or to use up their existing credit balance.

Customer Lifetime Value (LTV): Over a 6-12 month period, track the total spend of customers who engage with the store credit program versus those who don't. That gap is a powerful indicator of your ROI.

Time Between Purchases: A successful program will shrink the time it takes for a customer to come back and buy from you again.

When you focus on these metrics, you’ll see that store credit isn't just another expense—it's a powerful engine for profitable, sustainable growth.

Ready to stop giving away your margins with discounts and confusing points? Redeemly helps you build a Shopify loyalty program with native store credit that boosts LTV and AOV. Launch your profit-focused loyalty program today!

Join 7000+ brands using our apps