A Shopify Merchant's Guide to Reducing Churn Rate and Increasing LTV

Jan 20, 2026

|

Published

Let’s be honest, the endless cycle of discounts is a race to the bottom for most Shopify brands. Instead of building real loyalty that increases lifetime value (LTV), constant sales just train your customers to wait for the next promotion. It eats away at your margins and slowly devalues your products.

True loyalty isn't bought with a 15% off coupon; it's earned by creating genuine value that makes people want to come back, increasing their average order value (AOV) and LTV along the way.

Why Discounts Are Hurting Your Brand More Than Helping

The quick hit of a sale from a discount code is tempting, I get it. But it often masks a deeper problem that actually fuels customer churn. Every time you slash prices, you chip away at your brand's perceived value and, more critically, your bottom line.

This strategy tends to attract bargain hunters, not brand advocates. These are the shoppers who will leave the second a competitor dangles a slightly better deal. It’s a vicious cycle and a massive roadblock if your goal is long-term, sustainable growth fueled by high customer lifetime value.

Just look at the numbers. In the hyper-competitive world of e-commerce, the average churn rate is around 22% annually. That means more than one in five customers walks away each year if you don't have a solid retention plan.

But here’s the flip side, and it’s huge: reducing churn by just 5% can boost your profits by anywhere from 25-95%. That stat alone shows the incredible power of keeping the customers you’ve already won.

Shifting From Discounts To True Value

So, what's the alternative? Instead of temporary promotions and confusing point systems, a much more powerful approach is using Shopify's native store credit.

Think about it. Unlike fleeting coupon codes or points that require mental math, store credit feels like real cash sitting in a customer’s digital wallet. It creates a tangible, compelling reason for them to return to your store.

The psychological shift here is massive. A discount feels like a one-time saving. But store credit feels like an earned reward—money they already have waiting to be spent with you. This simple change flips the customer's mindset from "what can I save?" to "what can I buy next?"

This strategy directly moves the needle on two of the most important metrics for any DTC brand:

Average Order Value (AOV): Customers are naturally motivated to spend a little more to hit a reward tier. Think, "Spend $100, get $10 in credit."

Lifetime Value (LTV): That earned credit essentially guarantees a future visit, which is the first step in turning one-time buyers into loyal, high-LTV customers.

Here’s a quick breakdown of how store credit stacks up against the old-school tactics.

Store Credit vs Traditional Loyalty Tactics

Feature | Discount Codes | Points Systems | Native Store Credit (Redeemly) |

|---|---|---|---|

Financial Impact | Directly erodes profit margin on every sale. | Delayed liability, can be complex to account for. | Held as a liability until spent, protecting cash flow. |

Customer Experience | Transactional and often forgotten. | Confusing (e.g., "What are 500 points worth?"). | Simple and intuitive. Feels like real cash. |

Brand Perception | Can devalue products, trains customers to wait. | Can feel like a gimmick or too much work. | Builds a sense of earned value and reciprocity. |

Repeat Purchase | No guarantee of a next purchase. | Encourages repeat purchases, but with friction. | Directly incentivizes a return visit to "spend" their credit. |

Ultimately, moving away from the discount treadmill means you stop competing on price and start building a real, sustainable retention engine. For a deeper dive into the mechanics, you might be interested in our guide on what are cash back rewards and how they drive loyalty.

And while you're at it, exploring the strategic considerations for various types of deals on Amazon can offer a broader perspective on how different promotions impact brand perception and profitability in the wild.

How to Actually Measure Customer Churn on Shopify

You can't fix what you don't measure. It’s an old cliché, but when it comes to churn, it's the absolute truth. If you want to stop customers from walking away, you first need a crystal-clear picture of what’s actually happening in your business.

Just glancing at the total number of customers you lost this month is a vanity metric. It feels bad, sure, but it doesn't give you the clues you need to build a powerful retention strategy that actually works.

For DTC brands, the real story is buried in your Shopify analytics. True clarity comes when you stop obsessing over raw customer counts and start focusing on the metrics that reveal the health of your customer relationships—and directly impact your lifetime value and bottom line.

Go Beyond Basic Customer Counts

It's time to shift your focus from "how many left?" to "what did we lose, and why?" This means tracking more meaningful KPIs that paint a complete picture of customer behavior.

Here are the core metrics I always tell merchants to obsess over:

Revenue Churn: This is the big one. It measures the monthly recurring revenue you’ve lost from customers who churned. Think about it: losing one high-LTV customer who spends $200 per order is far more damaging than losing five customers who only ever spent $20. Revenue churn shows you the real financial bleed.

Repeat Purchase Rate: What percentage of your customers come back for a second, third, or even fourth purchase? A high repeat purchase rate is one of the strongest signals you have that your customers are happy and your LTV is growing.

Purchase Frequency: How often do your repeat customers actually buy from you? Knowing the typical time between orders is your secret weapon. It helps you pinpoint exactly when a customer is "at-risk" because they've gone longer than usual without making another purchase.

By tracking these key figures, you move from a vague sense of loss to a precise understanding of where and when your revenue is leaking. For a deeper dive, check out our guide on essential user retention metrics that every Shopify store owner should have on their dashboard.

Uncover Game-Changing Insights with Cohort Analysis

One of the most powerful tools in your retention toolkit is cohort analysis. It sounds technical, but the concept is simple: you group customers based on when they made their first purchase (for example, all customers who joined in January) and then watch how they behave over time.

Running a cohort analysis in Shopify can be an eye-opening experience. You might discover that customers you acquired during a big holiday sale have a low LTV and churn way faster than those who found you organically. Or maybe you'll see a huge drop-off after 60 days, which tells you there's a problem with your post-purchase engagement during that specific window.

Cohort analysis is like a time machine for your customer data. It lets you go back and see exactly where the journey went wrong for specific groups, so you can fix the problem for all the customers who come after them.

Segment Your Audience for Targeted Action

Once you have the data, the final piece of the puzzle is to segment your audience into actionable groups. This is how you stop using a one-size-fits-all approach and start tailoring your retention efforts for maximum impact.

I recommend starting with these three essential segments:

At-Risk Customers: These are the people who haven't purchased within your typical buying cycle. If most of your repeat buyers come back every 45 days, anyone who passes the 50-day mark without a purchase belongs here. It's time to reach out.

Loyal Advocates (High LTV): Pull a list of your top customers by LTV or purchase frequency. These are your VIPs. They deserve special recognition, early access, and rewards to keep them feeling valued and engaged.

One-Time Buyers: This is often your largest and most frustrating group. The goal here is to figure out why they didn't return and then create compelling, irresistible offers—like a bonus store credit—to incentivize that all-important second purchase and start building their LTV.

The financial stakes here are enormous. Companies lose a staggering $1.6 trillion every year to churn, with US businesses alone losing $136.8 billion from what are often avoidable customer drop-offs. With the average e-commerce retention rate hovering at a dismal 30%, being proactive isn't just a good idea—it's essential for survival.

But there's good news. Smart loyalty programs that offer real, tangible value can completely change the game, pushing renewal rates as high as 95.6% for businesses with compelling incentives. Getting this right is how you win.

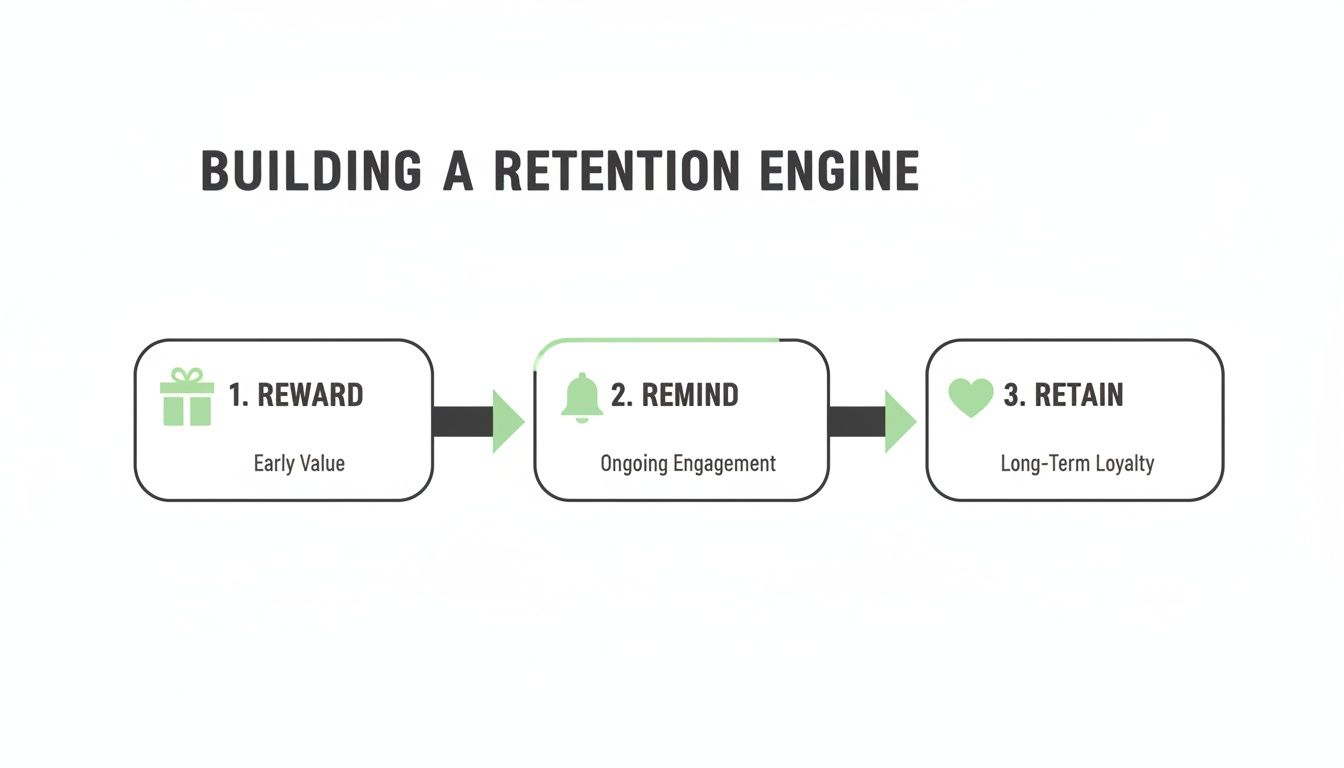

Turn Store Credit Into Your Retention Engine

Let's be honest: discount codes and confusing point systems are a short-term sugar rush. They might get you a sale today, but they do little to build a lasting relationship that increases lifetime value. It's time to stop just plugging leaks in your customer bucket and start building a real retention engine that gives people a compelling reason to want to come back.

This is where native Shopify store credit completely changes the game.

Forget complex point systems that make customers feel like they need a calculator to figure out their reward ("Wait, what's 500 points actually worth?"). Store credit is simple, direct, and has a huge psychological edge. It feels like real cash sitting in their account, earmarked specifically for your brand.

That simple shift flips a switch in the customer's mind. They aren't just getting 10% off; they have $10 of your store's money waiting to be spent. It’s a tangible reason to return, turning that first-time buyer into a high-LTV customer.

The "Found Money" Effect

The real power behind store credit is a psychological principle called mental accounting. When someone earns store credit, their brain doesn't treat it like their own hard-earned cash. Instead, it gets filed away as "found money"—a bonus that can only be spent with you.

This makes the decision to shop again almost effortless. They're not debating spending their money; they're figuring out how to use the money you've already given them.

By rewarding a customer with store credit, you're not just offering a discount. You're pre-loading their next shopping trip. You’re creating an open loop they feel a natural urge to close by coming back to spend what’s theirs.

This is a world away from a typical discount code, which is just a one-and-done transaction. Once the code is used, the incentive is gone. Store credit, on the other hand, forges an ongoing connection that boosts LTV.

Boost AOV and LTV in One Move

One of the most brilliant things about a store credit program is how it pulls double duty, lifting both your Average Order Value (AOV) and Lifetime Value (LTV) at the same time. You’re not just encouraging a second purchase; you’re encouraging a bigger first one.

Think about how you can structure a simple, tiered offer:

Spend $75, get $5 in store credit.

Spend $100, get $10 in store credit.

Spend $150, get $20 in store credit.

This kind of campaign immediately motivates shoppers to add just one more thing to their cart. Suddenly, a customer hovering at $85 sees they're close to a $10 reward and starts looking for a $15 item to get them over the line. Just like that, you've increased your AOV without slashing your margins on the initial sale.

And then, the hook is set. That $10 credit brings them back for another purchase down the road. This cycle—spend more, earn credit, come back to spend it—is the core of a profitable retention strategy. Over time, this is how you truly increase customer lifetime value and build a more predictable revenue stream.

Make Sure Your Customers See Their Credit

Even the most generous loyalty program is worthless if nobody knows they're a part of it. The key to making store credit work is keeping it visible and top-of-mind. This is where on-site reminders are absolutely essential.

With a native Shopify app like Redeemly, this entire process can be put on autopilot. The experience is seamless for you and, more importantly, for your customers.

Here’s what that looks like in practice:

Define Your Reward Rules: Start with something easy for customers to grasp, like a "Spend $100, Get $10" offer. You can find more tips on how to give store credit on Shopify and get it running in minutes.

Show Progress On-Site: As people add items to their cart, a small widget can pop up showing them how close they are to earning credit. This gamifies the experience and gives them a clear target to hit.

Add a Floating Wallet: The next time a customer visits, a floating icon can display their available store credit balance. It follows them as they browse, acting as a constant, friendly reminder of the value they have waiting.

Automate Email Nudges: If someone hasn’t used their credit after a few weeks, an automated email can give them a gentle nudge. A simple, "Hey, just a reminder you have $10 waiting for you!" is often all it takes to bring them back.

This system creates a perfect win-win. Customers feel genuinely appreciated for their loyalty, and your business gets a powerful, built-in engine for driving repeat sales.

A Quick Real-World Example

Imagine Sarah is shopping on your skincare site. She adds a $65 serum to her cart, and a small notification appears: "You're only $35 away from earning $10 in store credit!"

That's an easy decision. She finds a $40 moisturizer she’s been wanting to try, pushing her total to $105. She checks out, feeling good about her purchase, and instantly gets an email confirming her new $10 credit.

A few weeks go by. Sarah gets an automated email reminding her about that $10. She was already thinking about getting a new cleanser, and this is the perfect excuse. She heads back to your store, picks out a $25 cleanser, and only pays $15 out of pocket.

Look at what just happened in that simple flow:

You nudged the initial AOV from $65 up to $105.

You secured a second purchase that might have gone to a competitor, increasing her LTV.

Sarah feels smart and rewarded, creating a much stronger bond with your brand.

This isn't some overly complicated loyalty scheme. It's a straightforward value exchange that protects your margins while actively fighting churn. By swapping out flimsy discounts for a system that rewards loyalty, you build a healthier, more profitable business, one happy customer at a time.

Put Your Retention on Autopilot with Smart Automation

The sale isn't the finish line. It’s the starting line. That moment right after a customer clicks "buy" is your single best shot at locking in their next purchase and keeping them from churning. This is where you put your systems to work, and frankly, where native Shopify store credit becomes your secret weapon.

Instead of just hoping that post-purchase high lasts, you can build automated email and SMS flows that keep the good vibes going. By hooking a store credit app like Redeemly into your email platform, like Klaviyo, you can build a 24/7 retention machine that turns first-time buyers into high-LTV fans.

Nail Your First Impression with the Welcome Sequence

Your welcome series is so much more than a simple "thanks for signing up." It's your handshake, your introduction to the brand, and the perfect time to show new subscribers how you reward loyalty. Get this right, and you plant the seed for a long-term, high-LTV relationship from the very first email.

A welcome flow that actually works should:

Introduce your store credit program: Keep it simple. Explain how they can earn store credit, but frame it as a perk. "Earn cashback on every purchase" hits a lot harder than a complicated explanation of points.

Show them the money: Make the value crystal clear. "Spend $100, get $10 back to use on your next order." This makes the reward feel real and immediate.

Point them to their first reward: Give them a clear path to that first purchase. Remind them that they’ll start earning from day one.

This isn't complicated, but it's powerful. It tells your new customers that you see them as more than just a one-off transaction.

Celebrate Every Win with a Post-Purchase Flow

The second a customer earns store credit is a moment to celebrate. Don't just let it sit there silently in their account—shout it from the rooftops! An automated post-purchase flow is the perfect way to reinforce the value they just got and start them dreaming about their next order.

This flow needs to fire off immediately after they make a qualifying purchase. The tone should be upbeat and the message should be impossible to misunderstand.

Think of this email as a digital high-five. A subject line like, "You did it! You just earned $10 in store credit" is exciting. It instantly connects a great feeling to their purchase, making the reward feel tangible and valuable.

Inside the email, spell out their new balance and maybe drop a few hints about how they could spend it. This isn't a hard sell; it's a friendly reminder that keeps you on their mind and kickstarts a powerful loyalty loop. This simple rhythm of rewarding and reminding is the bedrock of any solid retention engine.

The real magic here is that it’s a continuous cycle. Rewarding a customer gives you a natural reason to remind them of their value, which is the most authentic way to keep them coming back.

The Win-Back Campaign: Your Secret Weapon

What about customers who've gone dark? That store credit sitting in their account is the most powerful tool you have to bring them back. A targeted win-back campaign built around the value they already have is insanely effective.

This isn't about sending a desperate "we miss you" discount. It's about reminding them they have "found money" just waiting to be spent.

These key automated flows are the workhorses of a strong retention strategy. They ensure no customer slips through the cracks and constantly reinforce the value you provide.

Key Retention Automation Flows

Campaign Name | Trigger | Primary Goal | Store Credit Angle |

|---|---|---|---|

Welcome Series | New Email/SMS Subscriber | Educate & Convert | Introduce the store credit program as a key brand benefit. |

Post-Purchase Flow | Customer Makes a Purchase | Encourage Repeat Purchase & Increase LTV | Immediately notify the customer of the credit they just earned. |

Win-Back Flow | Inactive Customer (e.g., 90 days) | Re-engage & Reactivate | Remind them of their existing credit balance as an incentive. |

Reactivation Flow | Dormant Customer (e.g., 180+ days) | Win Back Lost Customers | Offer a "credit topper" to their existing balance to spark interest. |

By automating these touchpoints, you build a safety net that not only reduces churn but also actively nurtures customers back into the fold in a way that feels helpful, not pushy.

Here’s a simple recipe I’ve seen work wonders for a store credit win-back flow:

Define Your "At-Risk" Segment: In your email platform, create a group of customers who have a store credit balance but haven't bought anything in, say, 90 days.

Send a Gentle Nudge: The first email is just a light touch. Something like, "Hey [First Name], did you know you have [$X.XX] waiting for you?"

Create a Little FOMO: A week later, follow up by showcasing new arrivals or best-sellers they could use that credit on.

Go the Extra Mile: For high-value customers who are still quiet, consider adding a small "credit topper." An email saying, "We just added an extra $5 to your account!" can be the final push they need.

By focusing on the value they already possess, you re-engage these customers on their own terms. It’s a margin-friendly, highly effective way to pull valuable shoppers back from the brink.

Measuring the True ROI of Your Store Credit Program

A great retention strategy has to do more than just give customers the warm-and-fuzzies—it has to prove its worth on the bottom line. Shifting from discounts to a native store credit system like Redeemly is a smart move, but if you can’t measure its financial impact, you’re flying blind.

This is where you connect your retention efforts directly to revenue. The goal is to move beyond vague feelings of "loyalty" and into hard numbers that show exactly how your program is boosting AOV and LTV. This data gives you the confidence to double down on what works.

Setting Your Pre-Implementation Baseline

Before you launch anything, you need to know your starting point. You can't prove you've improved if you don't have a clear "before" picture. Pull your key performance indicators (KPIs) for the last three to six months to create a solid baseline.

These are the core metrics that will tell the real story of your program's success:

Customer Lifetime Value (LTV): What’s the total average revenue you get from a single customer over their entire relationship with you? This is the ultimate health metric for retention.

Average Order Value (AOV): How much does a customer typically spend in one transaction? This will show if your reward tiers are actually encouraging bigger carts.

Repeat Customer Rate: What percentage of your customers have come back for a second (or third, or fourth) purchase? A rising rate here is a direct signal that your efforts are paying off.

Time Between Purchases: How long does it usually take for a customer to make their next order? Shortening this window is a massive win for your cash flow.

Document these numbers. They are your benchmarks for success. Everything you do from here on out will be measured against this initial data.

Tracking the Post-Launch Impact

Once your store credit program is live, the real work begins. You need to let it run for at least one full buying cycle (or a minimum of 90 days) to gather enough meaningful data. Now, you can run the same reports and compare your new KPIs against the baseline you just established.

Did your AOV jump by 15%? Has your LTV increased by 20%? These are the tangible results that prove your ROI.

Your store credit program isn't just a cost center; it's a growth investment. Tracking these metrics transforms it from an abstract "loyalty" expense into a measurable revenue driver with a clear, positive impact on your financial health.

This process highlights how store credit actively fights churn by creating a compelling, built-in reason for customers to return and spend more.

A/B Testing Your Way to Higher Profits

Look, you can't just set your reward structure and forget it. What resonates with one audience might fall flat with another. Continuous A/B testing is how you fine-tune your program to discover exactly what motivates your specific customers to spend more and come back faster, maximizing both AOV and LTV.

Consider testing different reward structures to see what really moves the needle on your KPIs.

Here’s a simple framework you can use:

Test Reward Thresholds: For one month, run a "Spend $75, Get $5" campaign. The next month, switch it up and test a "Spend $100, Get $10" offer. Does the higher threshold significantly boost AOV without tanking your conversion rate?

Experiment with Timing: Play with the reminder cadences for unused store credit. Does a nudge after 14 days work better than one after 30? You won't know until you test.

Analyze Segment Performance: Compare how different customer segments react. Your high-LTV VIPs might respond better to exclusive, high-value rewards, while a small bonus might be all it takes to reactivate at-risk, one-time buyers.

By constantly testing and iterating, you stop guessing what your customers want and start using data to build a perfectly optimized retention engine. This data-driven approach gives you undeniable proof that your store credit program isn't just creating happy customers—it's building a stronger, more resilient business.

Answering Your Top Questions About Store Credit

Even with a solid plan, I get it—moving away from discount codes and confusing points you know and trust can feel like a leap of faith. Let's walk through the most common questions and concerns I hear from Shopify merchants when they're ready to make this incredibly profitable shift.

Will My Customers 'Get' Store Credit as Easily as a Coupon?

They'll actually get it better. A 10% off coupon is just a transaction; it's here today, gone tomorrow, and easily forgotten. But store credit? That feels like having cash in a digital wallet, waiting to be spent. It has a real, tangible value that makes it feel more substantial and personal.

The secret is making it dead simple. Forget confusing point systems where shoppers have to do mental gymnastics to figure out what 500 points are actually worth. Store credit is straightforward: $10 is $10. With clear messaging on your site and a few automated email reminders, customers catch on instantly.

Store credit triggers what psychologists call the "found money" effect. It changes a customer's thinking from, "How much can I save on this order?" to "What can I buy with the money I already have in my account?" This subtle shift is powerful, turning a one-off purchase into an ongoing relationship and driving up lifetime value.

How Does Native Shopify Store Credit Work for Returns?

This is where store credit becomes a game-changer for your bottom line. When a customer makes a return, you typically have two options: swap the product or issue a cash refund. A refund means that revenue is gone for good.

Offering store credit as the default return option completely flips the script.

It keeps cash in your business. The money from that original sale stays right where it belongs—with you.

It guarantees a repeat purchase. That customer now has every reason to come back and find something else they'll love, turning a lost sale into a future one, thereby protecting LTV.

It makes for a better customer experience. Getting instant credit to find the right item is often way faster and more convenient than waiting days for a refund to hit their bank account.

By making store credit the easiest path for returns, you plug a major revenue leak and create a closed-loop system that keeps shoppers happily engaged with your brand.

Can I Control How Much I’m Giving Away?

Absolutely. This is the key to protecting your margins. You have total, granular control over your entire reward strategy. A smart store credit program isn't about handing out free cash; it's a strategic investment in your best customers to drive a higher average order value (AOV).

You can easily build profitable, tiered reward systems that work with your margins, not against them.

For instance, you could set up a campaign that looks something like this:

Spend $75, get $5 in credit

Spend $100, get $10 in credit

Spend $150, get $20 in credit

This kind of structure nudges shoppers to add just one more thing to their cart to unlock that next reward tier, boosting AOV right on the spot. And since the credit is only issued after a profitable purchase, you can be sure your program is fueling growth, not just eating into your costs. It’s a calculated investment in loyalty that truly pays for itself.

Ready to stop letting discounts chip away at your profits and start building a real retention engine? With a tool like Redeemly, you can launch a native Shopify store credit program that boosts AOV, increases LTV, and gives your customers a powerful reason to choose you again and again.

Join 7000+ brands using our apps