A Modern Retention Marketing Strategy for Shopify Stores

Jan 22, 2026

|

Published

A solid retention marketing strategy isn't just a "nice to have" for your Shopify store; it's the most direct path to profitable, sustainable growth. It’s all about a simple shift in focus: instead of pouring all your energy into the expensive hunt for new buyers, you double down on nurturing the customers you’ve already won over to maximize their lifetime value (LTV).

The Hidden Growth Engine In Your Shopify Store

Too many ecommerce brands are stuck in the "leaky bucket" cycle. They spend a fortune on ads to fill the bucket with new customers, only to watch them drain out the bottom after just one purchase. This constant chase for new business is exhausting and, frankly, an unsustainable way to build a brand.

A smart retention strategy is the plug that stops the leak.

But this isn't just about playing defense—it’s the best offense you have. Your existing customers are your greatest asset for unlocking higher lifetime value (LTV) and bumping up your average order value (AOV). Think about it: it costs a staggering 6-7 times more to land a new customer than it does to convince an existing one to buy again.

Beyond Discounts And Points

For a long time, the standard retention playbook has relied on two main tools: discount codes and complicated points programs. The problem is, these tactics often create more problems than they solve.

Discounts can be a race to the bottom. They train customers to wait for a sale, eroding your brand's value and crushing your profit margins.

Points systems often feel like a math quiz. They add friction to the buying process and rarely build the kind of genuine loyalty that drives up lifetime value.

These old-school methods build transactional relationships, not the real, emotional connections that lead to predictable revenue. If you're serious about increasing customer lifetime value, you need a better approach.

The core problem is that these old playbooks reward deal-hunting, not brand loyalty. They attract the wrong kind of customer and make it nearly impossible to improve your unit economics, lifetime value, and average order value over time.

This guide is about a more profitable way forward. We’ll walk through a modern retention strategy built on a simpler, more powerful incentive: native Shopify store credit. It’s a move away from margin-killing tactics and toward a tangible, cash-like reward that gives customers a real reason to return and spend more. By understanding what store credit is and how to use it, you can build a system that protects your profits while sending your LTV and AOV soaring.

Why Your Old Retention Playbook Is Killing Profits

Let's be honest. A lot of Shopify merchants are running their retention marketing on autopilot, leaning on the same old tactics that quietly chip away at their bottom line. The two biggest offenders? Aggressive discount codes and clunky points programs.

Sure, they might give you a quick sales bump, but over time, they do some serious damage. They train customers to hunt for deals, not to love your brand, slowly eroding the very loyalty you’re trying to build and depressing your customer lifetime value.

The Sugar Rush of Discount Codes

Discounts are easy. Too easy. Slapping a "20% OFF" banner on your site feels like a quick win, but it’s really just a sugar rush—a temporary high followed by a painful crash.

Soon enough, your customers learn to wait for the next sale. This bargain-hunting behavior eats into your margins and cheapens your brand perception. You end up in a race to the bottom, where the quality of your product takes a backseat to the size of the discount. That's not a sustainable retention marketing strategy for growing lifetime value.

The numbers tell a powerful story. A mere 5% increase in customer retention can boost profits by 25% to 95%. And when you remember that landing a new customer costs up to 7 times more than keeping a current one, a margin-friendly retention plan isn't just nice to have—it's essential. For a deeper dive, you can review the latest customer retention statistics and insights.

When Loyalty Points Create Confusion

Points programs seem like a good idea on paper. But in practice? They often create more headaches than they solve. Suddenly, your customers need a calculator to figure out what "5 points per dollar" actually gets them.

This complexity is a conversion killer. If a customer can't instantly understand the value of their loyalty, the incentive loses its power. They feel like they're working for a reward rather than being gifted one.

This friction leads to low engagement and even lower redemption rates, which defeats the whole purpose. The program feels disconnected from the actual shopping experience, failing to create that effortless, rewarding feeling that brings people back and boosts your average order value (AOV).

A Clearer Path with Native Store Credit

The real issue with discounts and points is they don't give customers a simple, compelling reason to come back. A modern retention marketing strategy has to be built on clarity, real value, and—most importantly—margin protection.

This is where native Shopify store credit completely changes the game. It provides a straightforward, profitable alternative that drives true loyalty without sacrificing your bottom line.

To see why it’s so effective, let's compare it directly to the old-school methods.

Store Credit vs Discounts vs Points Systems

Metric | Discount Codes | Points Programs | Shopify Store Credit |

|---|---|---|---|

Margin Impact | High. Slashes revenue directly off the top of every transaction. | Moderate. Becomes a cost only upon redemption, but can be unpredictable. | Low. A liability, not a cost, until a customer returns to make a new purchase. |

Customer Clarity | Clear. The value is obvious (e.g., 20% off). | Confusing. "Points" are an abstract currency that requires calculation. | Crystal Clear. $10 in credit is $10 to spend. No math needed. |

Purchase Behavior | Trains customers to wait for sales, devaluing full-price items. | Can feel like a chore, leading to low engagement and breakage (unredeemed points). | Encourages a return visit and often leads to a higher AOV as customers spend more. |

Brand Perception | Can cheapen the brand and attract one-time bargain hunters. | Can feel transactional and impersonal if the system is too complex. | Positions the brand as generous and customer-focused, building genuine goodwill. |

As you can see, store credit wins on almost every front. It’s simple for customers, protects your profits, and encourages the exact behavior you want: a quick return to your store to make another purchase.

Unlike a discount that cuts into your revenue on the spot, store credit is a promise that only costs you when a happy customer comes back—often spending more than the credit amount. It directly drives your most important retention goals: increasing lifetime value (LTV) and building a profitable, repeat customer base.

Store Credit: The Margin-Friendly Way to Win Customers Back

Think about it this way: would you rather get a crisp $10 bill or a coupon for 20% off your next purchase?

Most people would pick the cash, right? It feels more tangible, more valuable. That’s the simple but powerful idea behind building your retention marketing strategy with native Shopify store credit.

You’re not training your customers to wait for the next big sale or to hoard confusing points. Instead, you're giving them what feels like real money sitting in their account, ready to be spent. This taps into a powerful psychological trigger known as “mental accounting,” where we treat different types of money in different ways.

A discount just feels like a temporary price cut. But store credit? That feels like an asset, like money they’ve already earned. This subtle shift in perception can completely change how they think about shopping with you again. Suddenly, they have a very real, very compelling reason to come back.

How Store Credit Moves the Needle on Key Metrics

Here’s the beauty of it: unlike a discount that immediately eats into your revenue on a sale, store credit is just a liability on your books. It only becomes a cost when a happy customer returns to make another purchase. This model is engineered to directly improve the two metrics that define profitable growth: lifetime value (LTV) and average order value (AOV).

When customers know they can earn credit by spending a little more, many of them will. A simple offer like, "Spend $100, Get $10 back," is often all it takes to convince a shopper to add that one extra item to their cart. Just like that, you’ve nudged your AOV up on the spot.

And that earned credit? It’s a magnet. With $10 sitting in their account, that customer is far more likely to return for a second or third purchase, which directly boosts your repeat purchase rate and, over time, their total lifetime value.

A customer with store credit isn't just a past buyer; they're an active account holder with a balance to spend. This simple change transforms a one-time transaction into an ongoing relationship, turning the post-purchase phase into the start of the next sale.

The Power of a Seamless, Native Experience

This whole strategy becomes even more powerful when it feels completely seamless. A clunky, third-party app with confusing widgets and slow-loading pages just adds friction and cheapens the experience. This is where a native Shopify solution changes everything.

By using Shopify's built-in store credit system, the entire process feels natural and effortless for the customer:

Zero Friction: They see their credit and can apply it right at checkout, without ever leaving your site or logging into some other portal.

Instantly Understood: The balance is shown in dollars and cents, not abstract points. There’s no math required to understand its value.

Feels Like Your Brand: The experience is a core part of your store, not some tacked-on loyalty program that looks out of place.

This integrated approach is smart behavioral economics. The data is clear: loyal customers are 5 times more likely to make repeat purchases and 4 times more likely to refer a brand. Store credit taps right into this by creating a sense of ownership—it feels like their money, just waiting to be used. As you can see from the latest customer retention statistics, this simple shift is way more effective at getting people to act. It's a retention strategy that respects both your margins and your customers.

Four Essential Retention Marketing Playbooks

Alright, theory is great, but a winning retention marketing strategy is all about action. When you shift your focus from endless discounts to a smarter system like native Shopify store credit, you can roll out some seriously powerful, margin-safe playbooks. These are designed to drive repeat purchases and maximize lifetime value at every stage of the customer journey.

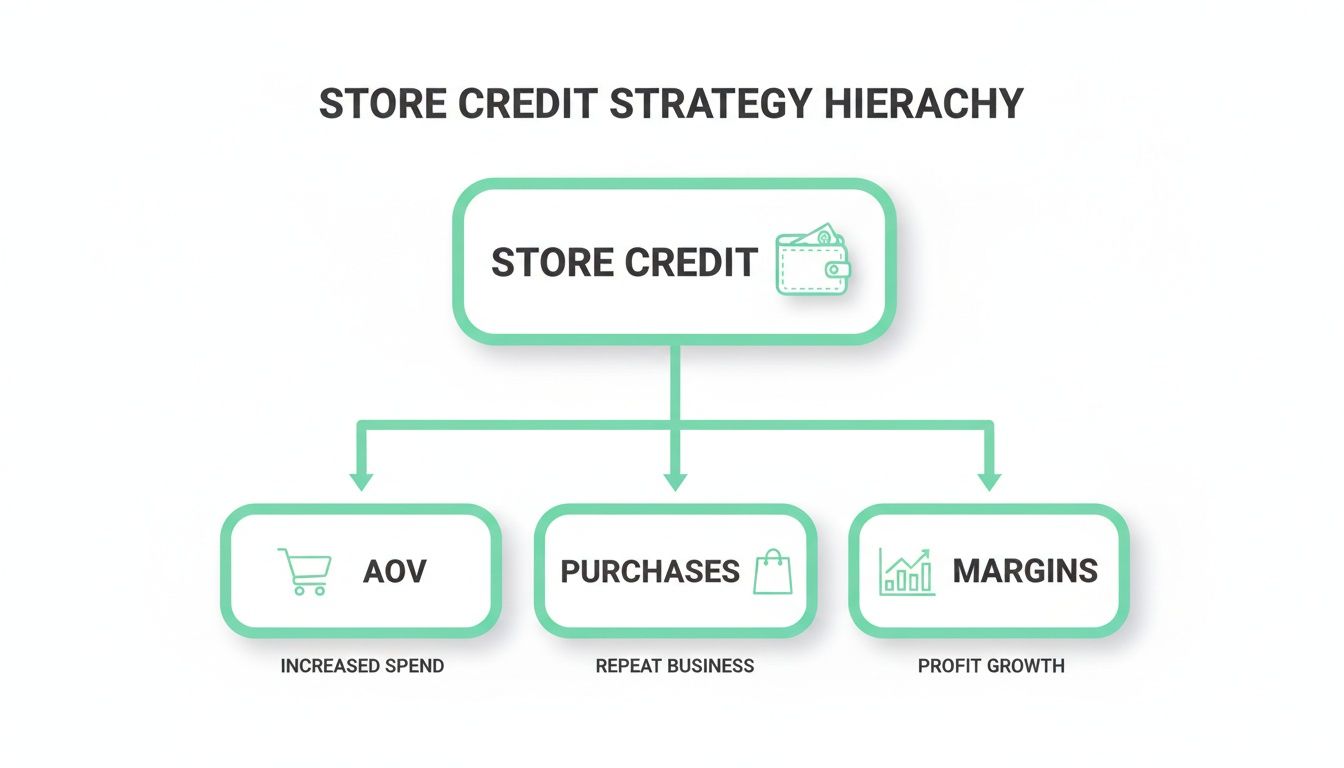

This diagram really nails how a simple store credit system can directly fuel the metrics that define a healthy, growing business.

As you can see, store credit becomes the engine that drives up Average Order Value, gets customers buying more often, and—most importantly—protects your profits. So, let's break down how to actually put this into practice with four essential playbooks.

The Welcome And First Purchase Playbook

The road to a high lifetime value starts the moment a new visitor lands on your site. Instead of greeting them with a generic "10% Off Your First Order" coupon that immediately eats into your margin, you can use store credit to lock in that first sale without cheapening your brand.

The Goal: Turn curious visitors into first-time buyers while planting the seed for a second purchase.

How It Works: Offer a small but enticing sign-up credit, maybe $5, just for creating an account or joining your email list. This feels like a genuine gift, not a desperate discount, creating goodwill from the get-go. With that credit sitting in their account, they have a real, tangible reason to follow through and complete that first purchase.

This one simple tweak changes the entire conversation. You're not just bribing them with a discount; you're starting a relationship with a positive balance, subtly encouraging them to see the long-term value in sticking with you.

The Post-Purchase And Second Order Playbook

The moments immediately following a customer's first purchase are make-or-break. This is your golden opportunity to turn a one-time transaction into a lasting relationship. Store credit makes this transition feel both seamless and irresistible.

The Goal: Dramatically increase your repeat purchase rate by giving customers a compelling reason to come right back.

How It Works: As soon as a customer completes their first purchase, automatically reward them with store credit. You could set up a simple rule like, "Spend $75, Get $7.50 in credit." Then, lean on automated emails and texts to remind them it's waiting for them.

Think about it. A message that says, "You've got $7.50 waiting for you!" hits so much harder than another generic marketing email. It’s personal. It’s urgent. It creates a powerful psychological pull to come back and spend the "money" they've already earned.

This playbook is the absolute heart of a profitable retention engine. It directly incentivizes that crucial second purchase—the single biggest indicator of a customer’s future lifetime value. For even more ideas, check out some other actionable retention marketing strategies in our complete guide.

The VIP And High-Value Customer Playbook

Let's be honest: not all customers are created equal. Your top spenders, the ones who truly love your brand, deserve to be treated like gold. Store credit is the perfect way to reward their loyalty without just throwing more discounts at them.

The Goal: Nurture your absolute best customers, get them to buy more often, and maximize their lifetime value.

How It Works: Build out exclusive reward tiers based on spending milestones. These should be simple and clear, so your top customers know exactly how to earn more credit, faster.

Tier 1 (VIP Spender): Customers who spend over $500 in a year earn 10% back in store credit on every single purchase.

Tier 2 (Brand Advocate): Customers who spend over $1,000 get 15% back plus early access to new product drops.

This approach gamifies the experience in a way that feels special and exclusive, not just transactional. It gives your best customers a clear reason to consolidate their spending with your brand, sending their lifetime value through the roof.

The Win-Back And Lapsed Customer Playbook

It happens. Sooner or later, some customers just go quiet. The old way of winning them back was to send a "We Miss You - 25% Off!" email, which is a classic margin-killer. Gifting store credit is a much smarter and safer way to reactivate them.

The Goal: Re-engage customers who have gone cold and bring them back into the fold without wrecking your brand's price integrity.

How It Works: First, identify customers who haven't bought anything in a specific timeframe, like 90 or 120 days. Instead of sending a discount that can look a little desperate, surprise them by gifting a small amount of store credit right into their account.

An email with the subject line, "A $10 Gift Is Waiting For You" is almost impossible to ignore. It’s an unexpected gesture that shows you value their business and gives them a no-strings-attached reason to come back and browse. This tactic is so effective because it feels like a genuine act of goodwill, rebuilding that connection and prompting a fresh look at what you have to offer.

How to Measure If Your Retention Strategy Is Actually Working

So, you've launched a killer retention marketing strategy. That’s a fantastic first step. But here's the hard truth: a plan without a scorecard is just a bunch of hopeful guesses. If you want to know if your efforts are actually making a difference, you have to track the right numbers.

This is a common trap for merchants. They get fixated on vanity metrics like social media followers or email open rates. Those feel good, but they don't pay the bills. A truly successful retention strategy moves the needle on the numbers that directly impact your bottom line, like lifetime value and average order value.

Let's break down the metrics that really matter.

Lifetime Value: Your North Star Metric

Customer Lifetime Value (LTV) is the single most important metric for a sustainable brand. It answers a simple question: what is a customer really worth to you over their entire relationship with your store? While acquisition gets them in the door, retention is what turns that first-time buyer into a long-term asset.

Think of it this way: a native Shopify store credit program is an LTV-generating machine. By giving customers a real, cash-like incentive to come back, you're engineering the very repeat purchases that build a high lifetime value. Every time a customer uses their credit, they're not just buying a product; they're deepening their loyalty and boosting their total spend with you.

Average Order Value: Fueling Every Transaction

Average Order Value (AOV) is exactly what it sounds like—it’s the average amount a customer spends each time they check out. Getting this number up is one of the fastest ways to grow revenue without spending a dime more on ads.

This is where a store credit strategy really flexes its muscles. An offer like, "Spend $100, Get $10 in credit," doesn't just reward a purchase; it actively encourages a bigger one. Shoppers see that tangible reward on the horizon and are far more likely to add one more item to their cart to hit the threshold. That little nudge directly bumps up your AOV.

A discount just cuts the price on a purchase someone was probably going to make anyway. A store credit reward, on the other hand, actively motivates customers to spend more to earn something valuable, making each transaction more profitable.

Repeat Purchase Rate: The Loyalty Litmus Test

Your Repeat Purchase Rate tells you what percentage of your customers have come back to buy from you more than once. This is the ultimate test of customer loyalty and satisfaction. A low rate means you have a "leaky bucket"—you're spending a fortune to acquire customers only to lose them right after the first sale.

The average ecommerce retention rate hovers around a disappointing 30%. But a store credit system gives you a serious competitive edge. It acts like a magnet, pulling customers back for that crucial second, third, and fourth purchase. With credit sitting in their account, the decision to shop with you again isn't just easy, it's a no-brainer. You can discover more insights about customer retention rates on Exploding Topics.

CAC Payback Period: Getting Your Money Back Faster

Your Customer Acquisition Cost (CAC) Payback Period measures how long it takes to earn back the money you spent to get a new customer. The shorter this period, the healthier your cash flow. A fast payback period means you can reinvest in growth much more quickly. For a deeper dive, check out our guide on the essential user retention metrics to track.

By boosting both LTV and AOV, a store credit program drastically shortens this payback window. You’re simply making more money, more quickly, from every single customer. That marketing spend you invested to get them in the first place pays for itself in record time, and every purchase after that is pure profit.

Your Simple Store Credit Launch Plan

Switching your retention strategy over to a store credit system might feel like a huge undertaking, but it’s a lot simpler than you think. Forget about those clunky, third-party apps that bog down your site. A native Shopify solution is built to be refreshingly straightforward. The trick is to start with a solid plan that puts transparency and customer value front and center.

This isn't just about launching another program. It's about giving your entire customer experience a serious upgrade. You're consciously moving away from the race-to-the-bottom world of discounts and into a system that actually rewards real loyalty, grows lifetime value, and protects your margins.

Let's walk through how to pull it off.

Step 1: Define Your Goals and Rules

Before you touch a single setting, you need to know what winning looks like. Don't be vague. Your goals have to be specific, measurable, and tied directly to the retention metrics that matter most to your business.

Set a Clear Objective: A great place to start is with a concrete target. Something like, "We want to boost our repeat purchase rate by 15% in the next six months."

Establish Simple Rules: This is where you leave complicated points systems in the dust. You need one, easy-to-understand rule that feels both generous and attainable. For instance, a "Spend $100, Get $10" rule is impossible to misunderstand and gives shoppers a clear goal to aim for.

The best reward rules are the ones that require zero mental math from your customers. The value should be so obvious it hits them instantly, making it a no-brainer to add that extra item to their cart or come back sooner.

This kind of clarity is the bedrock of your new strategy. When people know exactly how to earn and what they're getting, they'll actually use it.

Step 2: Customize Your On-Site Messaging

Okay, you've got your rules locked in. Now you have to make sure your customers actually see them. People can't get excited about a program they don't even know exists. A native Shopify app lets you weave messaging directly into your store's theme, keeping that store credit balance right where they can see it.

The goal here is to be consistent and encouraging, constantly reminding customers why it pays to shop with you.

The Floating Wallet Widget: Add a small, unobtrusive widget that follows customers around the site. This little icon should show them their current store credit balance at a glance, reminding them they have literal money waiting to be spent.

Product and Cart Page Banners: This is where you can get really effective. Use dynamic banners that update as they shop, showing them how close they are to their next reward. A little nudge like, "You're only $22 away from earning $10 in credit!" is a powerful psychological trigger that works wonders for increasing AOV.

Step 3: Announce the Big Upgrade

It's time for the reveal. The key is to frame this launch as a genuine improvement to their experience, not just another "loyalty program." You're moving to a simpler, more valuable system as a way of saying thanks for being a great customer.

Craft a dedicated email to your entire list explaining how the new store credit system works. Be sure to highlight its simplicity and the direct cash value. Position it as an exclusive perk, a better way of doing things, and you'll build immediate excitement and goodwill. This is how you make sure your new retention engine launches with some serious momentum.

Frequently Asked Questions

When Shopify merchants start thinking about swapping out their old loyalty program for a store credit system, a lot of questions pop up. It’s a big move—and a smart one—so it’s only natural to want to understand exactly how it’s going to work for your business.

Let’s tackle some of the most common questions we hear from store owners just like you.

Is Store Credit Really Better Than A Points System?

Hands down, yes. For the vast majority of Shopify stores, store credit just works better. The reason is simple: it’s instantly understandable. $10 in credit is $10 off your next purchase. There’s no mental math, no trying to figure out what 500 points really means.

That clarity makes a huge difference. When customers see that credit, it feels like they have cash just sitting in their account, waiting to be spent. It creates a powerful psychological nudge to come back and use it, which is exactly what you want. The end result is more repeat purchases and a higher lifetime value than you'll ever get from an abstract points system.

Won't Handing Out Store Credit Crush My Profit Margins?

Not at all. In fact, a well-run store credit program is one of the best ways to protect your profit margins. Think about it: a 20% off discount is an immediate, guaranteed hit to your revenue on that sale. Store credit, on the other hand, is a liability on your books, not an instant cost.

The "cost" only happens when a loyal customer comes back to make another purchase, which is the entire goal! You're rewarding future loyalty, not just giving away profit on the current sale.

This model encourages customers to return and often leads to a higher average order value (AOV), because they're spending their credit as part of a larger, full-priced order. You can even set up rules that reward customers with more credit when they spend more, directly boosting your profitability.

How Painful Is It To Switch Over To A Native Store Credit App?

It’s surprisingly easy. The beauty of a "native" Shopify solution is that it’s built on Shopify’s own technology. That means no clunky code, no complicated integrations, and nothing to slow down your site speed—a known conversion killer.

The whole process is usually just three quick steps:

Install the app right from the Shopify App Store.

Set up your simple, easy-to-understand reward rules.

Customize the on-site widgets to perfectly match your brand’s look and feel.

Most merchants are up and running in less than an hour, no developers needed. It’s a completely seamless switch for you and, more importantly, for your customers.

Ready to stop giving away your margins and build a retention strategy that actually grows your LTV? With Redeemly, you can launch a native Shopify store credit program that replaces confusing points and profit-killing discounts with a simple, powerful alternative.

Join 7000+ brands using our apps