Shopify Store Credits: The Secret to Higher LTV and AOV

Jan 18, 2026

|

Published

If you’re running a Shopify store, you know the pressure. Discounts, coupons, flash sales—they feel like the only way to get people to click “buy.” But what if that trusty old tactic is actually a slow leak, draining your store's lifetime value?

It's a trap so many of us fall into. We end up in a never-ending cycle of promotions that torpedo our margins and, worse, train our customers to never, ever pay full price. This transactional approach kills customer loyalty and prevents you from building a sustainable, high-growth business.

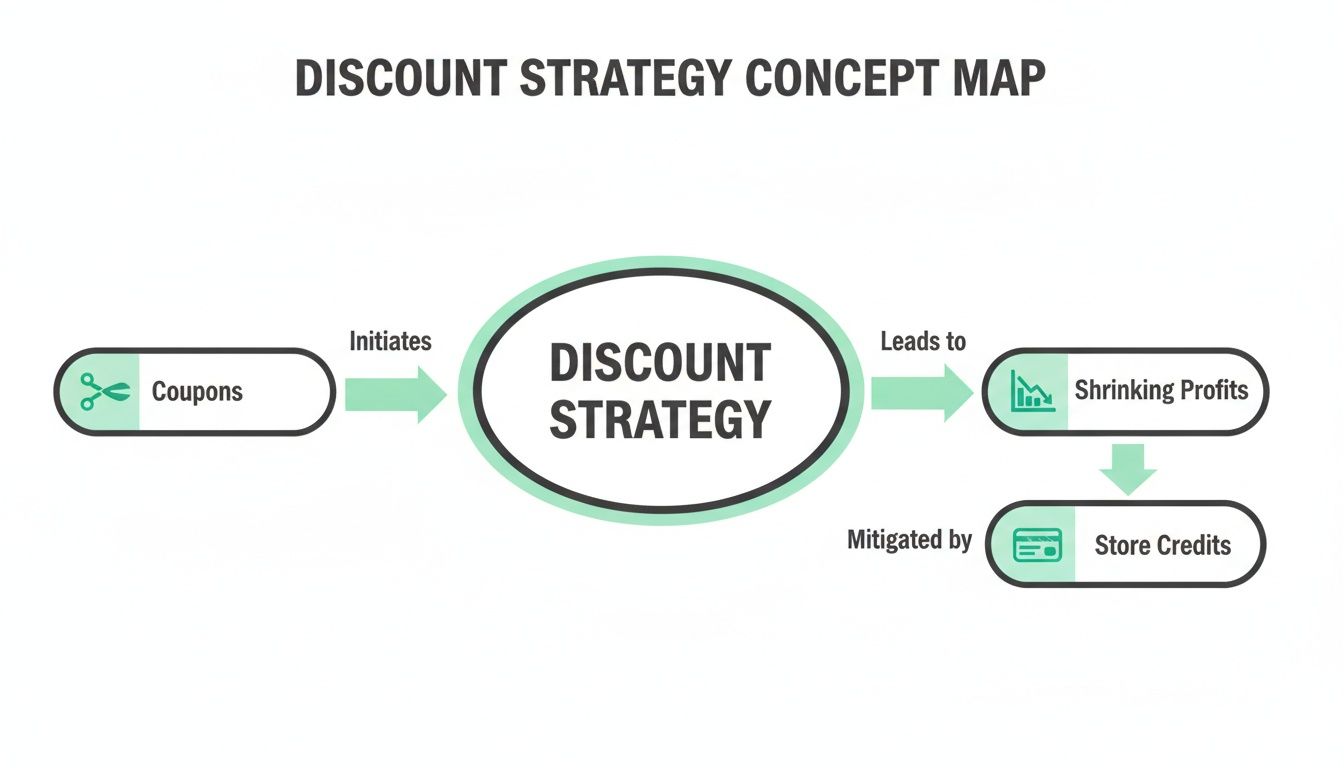

The Hidden Profit Drain in Your Discount Strategy

For a lot of stores, that "SALE" banner might as well be part of the logo. It feels essential just to keep up, but leaning on discounts creates a dangerous habit. Every 20% off coupon is a direct hit to your revenue on that sale, shrinking your margins and cheapening your brand in the eyes of your customers.

You end up attracting an audience of bargain-hunters, not loyal fans.

This whole approach conditions people to wait you out. Why would anyone buy today when they’ve learned a better deal is probably coming next week? You end up working against yourself, chasing short-term sales at the expense of building a healthy business focused on high lifetime value.

Moving Beyond Transactional Discounts

Here’s the fundamental problem: a discount is a one-way street. You just give value away. The customer gets a cheaper product, and you get a smaller profit. Full stop. The relationship ends at the transaction.

But there's a smarter way to drive sales—one that actually builds a bridge to the next purchase and increases both Average Order Value (AOV) and Customer Lifetime Value (LTV).

This is where native Shopify store credits completely change the game. Instead of slashing prices with coupons or confusing customers with points, you reward them with what is essentially "brand cash" they can only spend with you on a future order. It’s a small shift in mechanics but a massive shift in strategy, turning a single purchase into a long-term relationship.

Think of it this way: A discount says, "Here, take this for less." A store credit says, "Thanks for shopping with us. Here’s some money to come back and do it again." The first is a transaction. The second is the start of a relationship that builds LTV.

This simple pivot reframes the entire experience. Customers are no longer hunting for a deal; they're being rewarded for their loyalty, making them more likely to return and spend more over time.

The Power of Relational Rewards

When you put a native store credit system in place, you kickstart a powerful loop that fuels your most important growth metrics: LTV and AOV. You aren't just making a single sale; you're pre-funding the customer's next one. It's a profound change that can dramatically improve the financial health of your store.

Here’s how this new mindset changes things:

Boosts Average Order Value (AOV): Suddenly, customers have a reason to add one more item to their cart. They’ll often spend a little more just to hit a higher credit-back threshold, directly increasing the value of their current order.

Increases Customer Lifetime Value (LTV): That store credit is a powerful magnet. It pulls shoppers back for their second, third, and fourth purchases, turning one-time buyers into repeat customers and maximizing the total revenue they generate.

Protects Profit Margins: Unlike a discount that cuts into your revenue immediately, the cost of a store credit only gets realized on a future sale—a sale that you might not have gotten otherwise. If you're looking for more on this, we've got a whole guide on how to improve profit margins that digs deeper.

Ultimately, using native Shopify store credits lets you build a more resilient business. It’s your ticket to get off the discount treadmill and start building a real community of high-LTV customers who are invested in your brand, not just your promotions.

How Native Shopify Store Credits Actually Work

Think of native Shopify store credits as your store's own private currency—a form of "brand cash" that lives directly inside your customer's account. This isn't some clunky third-party app or a confusing points system that customers have to decipher. It's a clean, fully integrated balance that can only be spent in one place: your store.

That seamless, native integration is its real superpower. Customers don't have to hunt for coupon codes or navigate external widgets that bog down your site. When they earn credit, it just shows up in their account, ready and waiting for their next purchase.

The whole process is designed to be completely frictionless. At checkout, their available credit appears as a payment option, right alongside familiar choices like a credit card or PayPal. This simplicity elevates the reward from a simple discount into a premium perk, giving shoppers a powerful reason to come back and spend that balance.

This visual perfectly captures the strategic pivot from profit-draining coupons to a far more sustainable store credit model focused on customer lifetime value.

The bottom line? While old-school discounts drain revenue on the spot, store credits create a positive feedback loop of repeat business that protects your margins and grows your customer LTV.

The Power of a Closed-Loop System

Because native store credits can only be used at your store, you're essentially creating a powerful, closed-loop economy. You aren't just giving money away; you're reinvesting it directly back into your own business by guaranteeing future sales. This is a massive advantage over generic discount codes that often get shared all over the internet, unpredictably chipping away at your margins.

A discount code is a one-time transaction that ends the second a customer checks out. Store credit, on the other hand, is an ongoing conversation. It pulls them back for their next purchase, strengthening their loyalty and LTV with every dollar they spend.

This approach turns a simple purchase into the start of a long-term relationship. Every transaction that earns a credit simultaneously creates a compelling reason for the next one. You're building a self-sustaining cycle of customer retention that naturally boosts lifetime value.

Financial and Experiential Superiority

From a purely financial standpoint, the numbers speak for themselves. Traditional discounts can easily slash your margins by 20-30% on a single sale. But with store credits issued through Shopify's native system—like those powered by Redeemly—you only incur a cost when the credit is redeemed on a future purchase. This model not only preserves your profitability but also drives the repeat business that is essential for high LTV.

In fact, loyalty programs built around store credit can boost repeat purchase rates by 20-30%. That directly lifts customer LTV, especially in competitive markets like the US, where Shopify has a commanding 30% market share.

The native functionality also delivers a far better customer experience than confusing points systems. Shoppers don't have to juggle multiple apps or try to figure out complex conversion rates. Everything happens automatically, right inside the Shopify environment they already know and trust.

To really see the difference, let’s put these common incentive models side-by-side.

Store Credits vs Discounts vs Points: A Clear Comparison

This table breaks down how the three most common incentive models stack up, showing why a native store credit system is superior for merchants focused on LTV and AOV.

Feature | Native Store Credits | Discount Codes | Points Programs |

|---|---|---|---|

Customer Experience | Seamless & Intuitive. The credit appears automatically at checkout, feeling like a premium perk tied to their account. | Friction-Filled. Customers must find, copy, and paste codes, which can lead to cart abandonment if they don't work. | Complex & Confusing. Shoppers often don't know the value of their points or how to redeem them, reducing engagement. |

Profit Margin Impact | Delayed & Protected. The cost is only realized on a future sale, protecting the margin of the initial purchase. | Immediate & Damaging. Profits are cut instantly on the current sale, devaluing your product. | Opaque & Risky. The financial liability of unredeemed points can be difficult to track and manage. |

Loyalty Mechanism | Direct Incentive for LTV. Creates a clear, tangible reason for the customer to return and make another purchase. | Transactional Incentive. Attracts one-time bargain hunters rather than fostering genuine long-term loyalty and high LTV. | Abstract Incentive. The connection between earning points and tangible rewards is often weak and unmotivating for repeat purchases. |

At the end of the day, a native Shopify store credits system is much more than just another way to offer a deal. It's a strategic tool designed to protect your brand's value, elevate the customer journey, and build a more profitable, sustainable business by focusing on what really matters: lifetime value and average order value.

Driving Higher AOV and LTV with Every Purchase

Let's be honest, the real power of Shopify store credits isn't just about making customers feel good. It's about directly and measurably growing your two most important metrics: Average Order Value (AOV) and Customer Lifetime Value (LTV).

Unlike one-off discounts that accidentally train your customers to wait for a sale, store credits create a powerful psychological pull. They encourage people to spend more right now and come back to your store sooner. It’s a subtle shift that transforms a simple transaction into the beginning of a long-term, high-LTV relationship.

The Psychology of Boosting Your Average Order Value

Ever added an extra item to your cart just to hit the free shipping threshold? Of course you have. Store credits work on the exact same principle. You're giving your customers a clear, attainable goal that motivates them to increase their basket size, directly boosting AOV.

Think about this common scenario. You offer a $10 store credit on all orders over $100. A customer is sitting with $85 worth of products in their cart. They now have a compelling choice: check out now, or add a $15 item to get $10 back for next time.

For the customer, that extra $15 item no longer feels like it costs $15. In their mind, it's really only costing them $5 once they factor in the credit. That small mental shift makes adding it to the cart an incredibly easy decision, pushing your AOV higher.

This isn't about tricking anyone. It’s about giving them a smart, tangible reason to explore more of what you offer. By setting strategic reward tiers, you can consistently nudge your AOV upwards, order after order.

Creating a Powerful Retention Loop for Higher LTV

Boosting AOV is a great short-term win, but the real magic of store credits lies in building long-term LTV. It all comes down to creating a self-perpetuating retention loop.

Here’s how that cycle plays out:

First Purchase: A new customer buys something and earns their first chunk of store credit. Instantly, they have a real, monetary reason to come back.

The Return Incentive: That credit balance sitting in their account is like a magnet, pulling them back to your store far more effectively than another marketing email ever could.

Second Purchase & Reinforcement: They use their credit, feel savvy for getting a deal, and then earn new credit on their second purchase. This positive feedback loop strengthens their bond with your brand and increases their total LTV.

This cycle repeats, turning a one-time buyer into a loyal, high-LTV customer. Each purchase reinforces the last, building a habit that keeps them choosing you over your competitors. If you want to dive deeper into the numbers behind this, check out our complete guide on how to calculate customer LTV.

The Proven Impact on Repeat Purchases

This isn't just theory; the data backs it up. The average e-commerce conversion rate hovers around a meager 2.5%, but the smartest brands know the real money is made after the first sale. In fact, returning customers can drive 40% more revenue than first-time shoppers.

Well-designed reward programs are a huge driver of this. Studies show they can lift repeat purchase rates by 25%, which in turn boosts LTV by 15-30% in competitive niches like fashion and apparel. It’s clear that a focus on LTV isn't just good practice—it's the most profitable path forward.

Store credits are a core part of the comprehensive e-commerce growth strategies that build sustainable businesses. By replacing profit-eating discounts with a system that rewards loyalty, you stop chasing one-off sales and start building a predictable, profitable customer base with a high lifetime value.

Building a Winning Store Credit Program

Launching a great store credit program isn't about just flipping a switch. It’s about building a system that feels like a natural, valuable part of your brand experience. Unlike confusing points systems or aggressive, margin-killing discounts, the best store credit programs are simple, rewarding, and designed to maximize both AOV and LTV.

The real goal here is to create a framework that doesn't just reward loyalty but actively encourages it. Think of it as a gentle nudge, encouraging customers to spend a little more today and return a little sooner tomorrow. It all starts with setting up clear, achievable reward structures that make sense for your customers and your bottom line.

Defining Your Reward Structure

First things first: you need to decide how customers will actually earn credit. You're looking for a model that's dead simple to understand and directly encourages the behavior you want to see—bigger carts (AOV) and more frequent purchases (LTV). Keep it simple.

Two models work exceptionally well for most stores:

Percentage-Back Rewards: This is as straightforward as it gets. Customers get a set percentage of their purchase total back as store credit. For example, offering 5% back on every order is easy to communicate and feels like a consistent perk that encourages repeat business.

Fixed-Amount Tiers: This approach is all about boosting AOV. You set spending thresholds to unlock rewards. A classic example is offering $10 in credit for orders over $100, and $25 in credit for orders over $200. It subtly gamifies the shopping experience and pushes customers to add that one extra item to their cart.

Whichever path you choose, make sure the math works with your profit margins. The great thing about store credit is that the cost is only realized on a future purchase, but you still need to set a sustainable reward rate from day one.

Making Credit Visible and Valuable

Even the most generous store credit program is worthless if your customers don't know it exists. Visibility is everything. If you want people to use their credit, you have to keep their balance top-of-mind to drive that next purchase.

Think of a customer's credit balance as a prepaid invitation to return. If they can't see the invitation, they'll never show up for the party. Consistent, gentle reminders are the key to turning earned credit into redeemed revenue and higher LTV.

To pull this off, you need to sprinkle reminders about their credit balance across the entire customer journey:

Floating Wallet Widgets: An on-site widget that constantly shows a customer's credit balance while they browse is a game-changer. It's a persistent, positive reminder of the value they have waiting for them.

Checkout Reminders: This is a no-brainer. Display their available credit right in the checkout flow. It removes all friction and makes using their credit an effortless, satisfying click.

Email Notifications: Set up automated emails that fire when a customer earns new credit. If you set expirations, a "your credit is about to expire" email can be incredibly effective at bringing them back to your site.

Let's be real—managing all these moving parts takes time. For busy store owners, delegating program management is a smart move, and a dedicated Virtual Personal Assistant For Shopify Seller can be a huge help in keeping everything running smoothly.

Promoting Your Program for Maximum Impact

Okay, your structure is solid and you've made the credit visible. Now it's time to shout it from the rooftops. Don't let your new store credit program be your brand's best-kept secret. You need to actively promote it to both new and existing customers to drive adoption from the get-go.

A strong promotional push will ensure your program gets the attention it deserves. Here’s how to do it:

Homepage Banners: Slap a banner right on your homepage. Use clear, benefit-driven messaging like, "Earn 5% Back in Store Credit on Every Order."

Email Marketing Campaign: Dedicate a full email campaign to the launch. Explain how it works, what's in it for them, and maybe even offer a small starting credit to your most loyal customers to get the ball rolling.

Social Media Announcements: Create some eye-catching posts for your social channels. Frame it as a new, simpler way for your community to get rewarded for their loyalty.

By making your program simple, visible, and exciting, you turn it from a background feature into a powerful engine for customer retention, higher LTV, and profitable growth.

Protecting Your Margins and Unit Economics

Let's talk about profit. Not just top-line revenue, but the actual cash you get to keep. For years, the default playbook for ecommerce has been to slash prices with discounts. It gives you a quick sales bump, but it directly attacks your margins and teaches customers to devalue your products.

Thankfully, there's a smarter, more sustainable way to grow: native Shopify store credits.

Think about it. A coupon instantly carves a chunk out of your revenue on the current sale. A store credit, on the other hand, is different. Its cost only hits your books when a customer comes back to make a future purchase.

This simple delay completely changes the financial picture. It creates a healthier cash flow cycle and makes your revenue far more predictable. Suddenly, a cost center is transformed into a powerful engine for repeat business that increases LTV. This is how you break free from the cycle of reactive, deep-discount sales and stop coupon abuse in its tracks. You start building a system that rewards genuine loyalty and fosters a truly profitable business.

Improving Your Unit Economics

Every transaction in your store has its own mini profit-and-loss statement. We call this unit economics—a simple calculation that factors in your cost of goods, marketing spend, and those unavoidable transaction fees. Native store credits make this math look a whole lot better.

Here’s a practical example of how it plays out:

Initial Sale: A customer spends $100 and earns a $10 store credit. Right now, you’ve collected the full $100. Your margin on this sale is fully protected.

Future Sale: That customer returns, excited to use their $10 credit on a new $50 purchase. That second sale—which might never have happened without the credit—still brings in $40 in fresh cash, directly boosting their lifetime value.

This model is a game-changer for financial planning. You're essentially pre-funding a future sale while maximizing the revenue you get today. It turns what could have been a one-and-done transaction into a profitable, two-part relationship that fuels LTV growth.

Avoiding the Discount Death Spiral

The damage from discounts runs deeper than the percentage you see on the screen. Take credit card processing fees, which typically run 2.5-2.9% + 30¢ on Shopify Payments. Those fees are calculated on the final, discounted price, which means they’re eating into an already smaller profit.

In contrast, store credit apps that are native to Shopify, like Redeemly, defer the reward's cost until it's actually redeemed. This dramatically improves your unit economics while also boosting AOV and customer LTV. It’s no surprise that high-growth merchants on Shopify Plus can achieve an incredible 126% YoY expansion—crushing the average—by using smart incentives that don't gut their margins. You can dig into more data on how top store credit apps improve merchant economics on skailama.com.

By issuing a store credit instead of a discount, you are not just giving away value; you are investing it back into your own ecosystem. You are paying to acquire a second purchase from a customer you’ve already won over—a far more efficient use of capital than acquiring a new one.

This strategic shift away from upfront discounts protects two of your most valuable assets: your brand's perceived value and your bottom line. You stop training customers to wait for the next big sale and start building a healthier business with a high customer lifetime value.

How to Move from Points to Store Credits

Let's be honest: switching from a confusing points program or a discount-heavy strategy can feel daunting. But think of moving to native Shopify store credits less as a difficult change and more as a strategic upgrade. You're simplifying things for yourself and, more importantly, creating a far better, more intuitive experience for your customers.

The key is framing the switch correctly. This isn't about taking something away; it's about giving your customers something better. Instead of earning abstract points with a vague cash value, they'll now earn real, spendable credit. It's like you're handing them a digital gift card with every purchase. That kind of clarity is a huge win for engagement and repeat business, which are the cornerstones of high LTV.

Your Smooth Transition Checklist

A successful switch all comes down to planning and communication. The last thing you want is for loyal customers to feel confused or like they've lost out. A solid plan ensures everyone—from your team to your most dedicated shoppers—is on board and excited about the new, simpler system.

Here's a simple, four-step checklist to guide your move:

Audit Your Current Strategy: Before you rip anything out, take a hard look at what’s working and what isn’t. Dig into your discount usage and points redemption rates. Are customers actually cashing in their points, or is it a system that only a handful of people ever use?

Calculate a Fair Conversion Rate: This is where trust is won or lost. You have to convert your customers' existing points into store credit. Make it simple and generous, like 100 points = $1.00. A clean conversion makes the move feel like a clear upgrade for them.

Plan Your Launch Communication: Start drafting your announcement emails, social media posts, and on-site banners now. The messaging needs to be relentlessly positive. Focus on simplicity and value with headlines like, "No more confusing points!" or "Your rewards are now like cash in your account!"

Launch and Celebrate: When you go live, make it an event. A great way to build goodwill is to offer a small bonus credit to all your existing loyalty members. It's a small gesture that says "thank you" for coming on this journey with you and turns a simple system change into a moment of brand connection.

The goal is to make the change feel like an undeniable improvement. When customers see their abstract points balance transform into a clear dollar amount, the value of their loyalty becomes instantly more apparent and compelling.

Ultimately, this move simplifies your tech stack and makes your loyalty program far more effective. For merchants weighing their options, understanding how store credits work natively is a game-changer. If you're digging into the research, you can compare Shopify loyalty programs to see exactly how a native credit system stacks up. This isn't just about changing tactics; it's about building a stronger, more profitable relationship with every single customer.

Still on the Fence? Let's Tackle Those Lingering Questions

Switching from the familiar territory of discounts to something new like store credits naturally brings up a few questions. I get it. You're wondering about the real-world impact on LTV, how your customers will react, and what it’s going to take to get it all running.

Let's walk through the most common questions merchants have right before making the switch.

Do Store Credits Really Move the Needle on LTV and AOV?

They absolutely do, and it’s all about changing the customer's mindset. Discounts are a one-and-done deal; they get a bargain and they're gone. Store credits, on the other hand, create a powerful incentive to come back.

When a customer gets credit from a purchase, you've just given them a concrete, financial reason to shop with you again. That second purchase is where the magic happens. They often add more to their cart to "spend" their credit wisely, which pushes up your Average Order Value (AOV). This cycle of earning and spending is what builds real, long-term Lifetime Value (LTV).

Think of it this way: a discount ends the conversation. A store credit starts a new one. You’re not just closing a sale; you're pre-funding their next purchase, and that's a much smarter way to build a loyal, high-LTV customer base.

But Will My Customers 'Get' It?

Yes, and they’ll probably thank you for it. Shoppers are exhausted by the song and dance of complicated points systems and the endless hunt for coupon codes that may or may not work.

Shopify store credits are refreshingly simple. It’s cash. Money in their account, ready to spend.

When you make their balance obvious—say, with a clean on-site wallet or a clear notification at checkout—it clicks instantly. It feels less like a marketing gimmick and more like a genuine perk of shopping with you, which is fantastic for your brand's perception.

Is This a Pain to Set Up on Shopify?

Not even close. This is the beauty of a solution that works natively with Shopify. You're not wrestling with clunky third-party apps that slow your site down with heavy code and awkward pop-ups.

A native store credit system integrates right into your existing Shopify setup. The process is usually quick and painless, with no deep technical skills needed. You can get up and running, issuing margin-friendly rewards that actually grow your business by boosting LTV and AOV, in no time at all.

Stop letting discounts eat away at your profits. Redeemly helps you build a healthier business by replacing coupons and confusing points systems with a native Shopify store credit program designed to boost LTV and protect your margins. Start growing sustainably today.

Join 7000+ brands using our apps